èÎ‡Ì ‚ÎÓÊÂÌËÈ Hansa Pensijas “ëÚ‡·ËθÌÓÒÚ¸” ëééÅôÖçàÖ ìèêÄÇãüûôÖÉé ëêÖÑëíÇÄåà

реклама

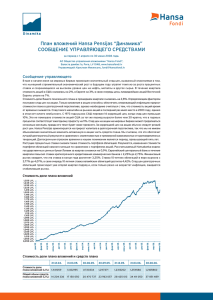

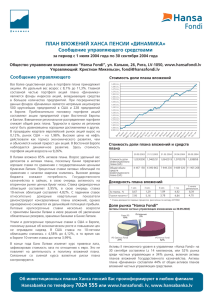

èÎ‡Ì ‚ÎÓÊÂÌËÈ Hansa Pensijas “ëÚ‡·ËθÌÓÒÚ¸” ëééÅôÖçàÖ ìèêÄÇãüûôÖÉé ëêÖÑëíÇÄåà Á‡ ÔÂËÓ‰ Ò 1 ‡ÔÂÎfl 2008 „Ó‰‡ ‰Ó 30 ˲Ìfl 2008 „Ó‰‡. Aé é·˘ÂÒÚ‚Ó ÛÔ‡‚ÎÂÌËfl ‚ÎÓÊÂÌËflÏË “Hansa Fondi”, Ň·ÒÚ‡ ‰‡Ï·ËÒ 1a, êË„‡, LV 1048, www.hansafondi.lv ìÔ‡‚Îfl˛˘ËÈ: äËÒÚË‡Ì åËÍÂÎÒÓÌÒ, [email protected] ëÓÓ·˘ÂÌË ÛÔ‡‚Îfl˛˘Â„Ó ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ ˝ÚÓÏ Í‚‡Ú‡Î ‚ÓÁÓÒ· ̇ 1,16%. êÓÒÚ ÒÚÓËÏÓÒÚË Ô·̇ Ó·ÂÒÔ˜ËÎ ‰ÂÔÓÁËÚÌ˚È ÔÓÚÙÂθ, ‚ ÚÓ ‚ÂÏfl Í‡Í ÒÚÓËÏÓÒÚ¸ ÔÓÚÙÂÎfl Ó·ÎË„‡ˆËÈ ÍÓη‡Î‡Ò¸, Ë Ó·˘‡fl ‰ÓıÓ‰ÌÓÒÚ¸ ÔÓÚÙÂÎfl ·˚· ÌËÊ ˜ÂÏ ‚ 1-Ï Í‚‡Ú‡ÎÂ. ç‡ ˚Ì͇ı Ó·ÎË„‡ˆËÈ ÓÔ‡ÒÂÌËfl ÔÓ ÔÓ‚Ó‰Û ÓÒÚ‡ ËÌÙÎflˆËË ‚˚Á‚‡ÎË ÒÌËÊÂÌË ˆÂÌ Ì‡ „ÓÒÛ‰‡ÒÚ‚ÂÌÌ˚ ӷÎË„‡ˆËË ‚ ‚Ó, ˜ÚÓ ÒÓÓÚ‚ÂÚÒÚ‚ÂÌÌÓ ÔÓ‚˚¯‡ÂÚ ÓÊˉ‡ÂÏÛ˛ ‰ÓıÓ‰ÌÓÒÚ¸ ‰Ó ÔÓ„‡¯ÂÌËfl Ó·ÎË„‡ˆËÈ. ÑÓıÓ‰ÌÓÒÚ¸ 10-ÎÂÚÌËı Ó·ÎË„‡ˆËÈ ÉÂχÌËË ‰Ó ÔÓ„‡¯ÂÌËfl ‚Ó 2-Ï Í‚‡Ú‡Î ‚ÓÁÓÒ· Ò 3,90% ‰Ó 4,62% ÔË ÒÌËÊÂÌËË ˆÂÌ˚ Ó·ÎË„‡ˆËË Ì‡ 4,2%. ëÌËÁË·Ҹ Ú‡ÍÊ ÒÚÓËÏÓÒÚ¸ „ÓÒÛ‰‡ÒÚ‚ÂÌÌ˚ı Ó·ÎË„‡ˆËÈ ã‡Ú‚ËË, Óڇʇfl ÓÒÚ Ó·˙ÂÏÓ‚ „ÓÒÛ‰‡ÒÚ‚ÂÌÌÓ„Ó Á‡Èχ Ë ÔÓ‚˚¯ÂÌÌ˚ ÔÓˆÂÌÚÌ˚ ÒÚ‡‚ÍË ÌÓ‚˚ı ˝ÏËÒÒËÈ – ÔÓ Ó‰ÌӄӉ˘Ì˚Ï Ó·ÎË„‡ˆËflÏ ‚ ·ڇı Ô‡‚ËÚÂθÒÚ‚Ó Ô·ÚËÚ 6,85% ‚ „Ó‰. ëÚ‡·ËθÌÛ˛ ‰ÓıÓ‰ÌÓÒÚ¸ Ó·ÂÒÔ˜˂‡˛Ú ·ÚÓ‚˚ ‰ÂÔÓÁËÚ˚ ‚ ÍÓÏϘÂÒÍËı ·‡Ì͇ı, „‰Â ÒÚ‡‚͇ ÍÓηÎÂÚÒfl ÓÍÓÎÓ 8% ‚ „Ó‰. å˚ Û‚Â΢ËÎË ‚ÎÓÊÂÌËfl ‚ ·ÚÓ‚˚ ‰ÂÔÓÁËÚ˚ Ë Ó·ÎË„‡ˆËË. ÑÂÔÓÁËÚ˚ ‡ÁÏ¢ÂÌ˚ ÚÓθÍÓ ‚ ÍÛÔÌÂȯËı ·‡Ì͇ı ã‡Ú‚ËË, „‰Â ‡ÍˆËÓ̇ÏË fl‚Îfl˛ÚÒfl „ÓÒÛ‰‡ÒÚ‚Ó ËÎË ÒÚ‡·ËθÌ˚ ËÌÓÒÚ‡ÌÌ˚ ·‡ÌÍË, Ë ÔÓˆÂÌÚÌ˚ ÒÚ‡‚ÍË ÔÓ ‰ÂÔÓÁËÚ‡Ï Ô‚˚¯‡˛Ú ‰ÓıÓ‰ÌÓÒÚ¸ „ÓÒÛ‰‡ÒÚ‚ÂÌÌ˚ı ‰Ó΄ӂ˚ı Ó·flÁ‡ÚÂθÒÚ‚. äÛÒ Î‡Ú‡ Í Â‚Ó ‚ ԉ·ı ÍÓˉӇ ÍÓη‡ÌËÈ Å‡Ì͇ ã‡Ú‚ËË ÒÌËÁËÎÒfl, ˜ÚÓ ‰Â·ÂÚ ‚ÎÓÊÂÌËfl ‚ ·ڇı ¢ ‚˚„Ó‰ÌÂÂ. ÑÎfl ‡ÒÔ‰ÂÎÂÌËfl ËÒÍÓ‚ ˜‡ÒÚ¸ ËÌÒÚÛÏÂÌÚÓ‚ Ò ÙËÍÒËÓ‚‡ÌÌ˚Ï ‰ÓıÓ‰ÓÏ ‚ÎÓÊÂ̇ ‚ ‚Ó. èÓ‰ ‚ÎËflÌËÂÏ ËÌÙÎflˆËË ‡ÒÚÂÚ ‚ÓÁÏÓÊ̇fl ÓÚ‰‡˜‡ ‰Îfl ËÌ‚ÂÒÚÓÓ‚ ÔÓ ‚ÎÓÊÂÌËflÏ ÌËÁÍÓ„Ó ËÒ͇. ÑÓıÓ‰ÌÓÒÚ¸ Ó‰ÌӄӉ˘Ì˚ı Ó·ÎË„‡ˆËÈ ÉÂχÌËË ‚ÓÁÓÒ· Ò 3,77% ‚ ÍÓ̈ χڇ ‰Ó 4,68% ‚ ÍÓÌˆÂ Ë˛Ìfl. ùÚÓ ÓڇʇÂÚ ÔÓ„ÌÓÁ ËÌ‚ÂÒÚÓÓ‚ ÓÚÌÓÒËÚÂθÌÓ ÓÒÚ‡ ËÌÙÎflˆËË. Ç Ë˛Ì „Ó‰Ó‚‡fl ËÌÙÎflˆËË ‚ ‚ÓÁÓÌ ‰ÓÒÚ˄· 4,00%, Ë Ö‚ÓÔÂÈÒÍËÈ ˆÂÌڇθÌ˚È ·‡ÌÍ (ÖñÅ) ÔÓ„ÌÓÁËÛÂÚ, ˜ÚÓ ËÌÙÎflˆËfl ‚ 2008 „Ó‰Û ÒÓÒÚ‡‚ËÚ ‚ Ò‰ÌÂÏ 3,4%, ‡ ‚ 2009 „Ó‰Û 2,4%. é‰Ì‡ÍÓ ËÌ‚ÂÒÚÓ˚ ‰Ó‚ÓθÌÓ ÒÍÂÔÚ˘Ì˚ ÔÓ ÓÚÌÓ¯ÂÌ˲ Í ÒÌËÊÂÌ˲ ËÌÙÎflˆËË Ë ÚÂ·Û˛Ú ·Óθ¯ÂÈ ÔÂÏËË Á‡ ÔËÌflÚË ËÌÙÎflˆËÓÌÌÓ„Ó ËÒ͇. ìԇ· Ú‡ÍÊ ÒÚÓËÏÓÒÚ¸ ‰Û„Ëı ÌËÁÍÓ„Ó ËÒ͇ Ë ËÒÍÓ‚‡ÌÌ˚ı Ó·ÎË„‡ˆËÈ, Ë ‚ ÂÁÛθڇÚ ˝ÚÓÚ Í‚‡Ú‡Î Ó͇Á‡ÎÒfl Ó‰ÌËÏ ËÁ ‰ÍËı Í‚‡Ú‡ÎÓ‚, ÍÓ„‰‡ Ó‰ÌÓ‚ÂÏÂÌÌÓ ÒÌËʇ·Ҹ ÒÚÓËÏÓÒÚ¸ Í‡Í ‡ÍˆËÈ, Ú‡ÍË Ë Ó·ÎË„‡ˆËÈ. Ç ÔÓÚÙÂΠÔ·̇ Û‰ÂθÌ˚È ‚ÂÒ ‚ÎÓÊÂÌËÈ ‚ ·ڇı Ò ‡Á΢Ì˚Ï ÒÓÍÓÏ ÒÓÒÚ‡‚ÎflÂÚ ÓÍÓÎÓ 75%, ‡ ÓÒڇθÌ˚ ‡ÍÚË‚˚ ‚ÎÓÊÂÌ˚ ‚ ‚ÓÓ·ÎË„‡ˆËË Ò ÌËÁÍËÏ Í‰ËÚÌ˚Ï ËÒÍÓÏ. í‡ÍÓ ‡ÒÔ‰ÂÎÂÌË ‚ÎÓÊÂÌËÈ Ô·ÌËÛÂÚÒfl ÒÓı‡ÌflÚ¸ Ë ‚ ‰‡Î¸ÌÂȯÂÏ. ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ÎÓÊÂÌËÈ 1,175 LVL 1,155 LVL 1,135 LVL 1,115 LVL 1,095 LVL 1,075 LVL 1,055 LVL 1,035 LVL 1,015 LVL Ë˛Ì¸ 08 Ï‡Ú 08 ‰ÂÍ 07 ÒÂÌÚ 07 Ë˛Ì¸ 07 Ï‡Ú 07 ‰ÂÍ 06 ÒÂÌÚ 06 Ë˛Ì¸ 06 Ï‡Ú 06 ‰ÂÍ 05 ÒÂÌÚ 05 Ë˛Ì¸ 05 Ï‡Ú 05 ‰ÂÍ 04 ÒÂÌÚ 04 Ë˛Ì¸ 04 Ï‡Ú 04 ‰ÂÍ 03 ÒÂÌÚ 03 Ë˛Ì¸ 03 Ï‡Ú 03 ‰ÂÍ 02 0,995 LVL ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ÎÓÊÂÌËÈ Ë Ò‰ÒÚ‚ Ô·̇ 31.03.07. 30.06.07. 30.09.07. 31.12.07. 31.03.08. 30.06.08. ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ÎÓÊÂÌËÈ (LVL) 1,0997155 31.12.06. 1,0932064 1‚1103542 1,1198449 1,1286544 1,1468871 1,1602433 é·˘ËÈ Ó·˙ÂÏ Ò‰ÒÚ‚ Ô·̇ ‚ÎÓÊÂÌËÈ (LVL) 7 207 044 8 023 122 9 971 322 11 665 709 14 973 559 17 507 115 22 835 446 ÑÓıÓ‰ÌÓÒÚ¸ Ô·̇ ‚ÎÓÊÂÌËÈ èËÓÒÚ Á‡ ÔÂËÓ‰, % 1 ÏÂÒ. 3 ÏÂÒ. 6 ÏÂÒ. 1 „Ó‰ 3 „Ó‰‡ ë ̇˜‡Î‡ ‰ÂflÚÂθÌÓÒÚË 0,17 1,16 2,80 4,49 5,85 16,02 4,48 1,91 2,75 ÉÓ‰Ó‚˚ ÔÓˆÂÌÚ˚ (*) * — „Ó‰Ó‚‡fl ÔÓˆÂÌÚ̇fl ÒÚ‡‚͇ ‰ÓıÓ‰ÌÓÒÚË ‡ÒÒ˜Ëڇ̇ ÔÓ ÏÂÚÓ‰Û ACT/365 ÑÓÎfl ˚Ì͇ “Hansa Fondi” (‡ÍÚË‚˚ Ô·ÌÓ‚ ‚ÎÓÊÂÌËÈ ˜‡ÒÚÌ˚ı ÛÔ‡‚Îfl˛˘Ëı ̇ 30.06.2008.) Hansa Fondi SEB Wealth Management Parex Asset Management èӘˠ41,3% 22,5% 19,8% 16,4% ÄÍÚË‚˚ II ÔÂÌÒËÓÌÌÓ„Ó ÛÓ‚Ìfl ÔÓ‰ ÛÔ‡‚ÎÂÌËÂÏ “Hansa Fondi” ̇ 30 ˲Ìfl ÒÓÒÚ‡‚ÎflÎË Ls 149 ÏËÎÎËÓÌÓ‚, ˜ÚÓ ÒÓÓÚ‚ÂÚÒÚ‚ÛÂÚ ‰ÓΠ˚Ì͇ 41,3% ÒÂ‰Ë ˜‡ÒÚÌ˚ı ÛÔ‡‚Îfl˛˘Ëı. ÄÍÚË‚˚ “ëÚ‡·ËθÌÓÒÚË” ÒÓÒÚ‡‚Îfl˛Ú 6,3% Ó·˘Ëı ‡ÍÚË‚Ó‚ Ô·ÌÓ‚ ‚ÎÓÊÂÌËÈ ˜‡ÒÚÌ˚ı ÛÔ‡‚Îfl˛˘Ëı Ò‰ÒÚ‚‡ÏË. 10 ÍÛÔÌÂȯËı ‚ÎÓÊÂÌËÈ ÇÎÓÊÂÌË LJβڇ чڇ ÔÓ„‡¯ÂÌËfl ì‰ÂθÌ˚È ‚ÂÒ**, % é·ÎË„‡ˆËË European Investment Bank EUR 15.04.2013. 4,59% é·ÎË„‡ˆËË ING Bank EUR 21.05.2010. 4,09% é·ÎË„‡ˆËË Svenska Handelsbanken EUR 21.05.2010. 4,08% ëÓ˜Ì˚È ‰ÂÔÓÁËÚ ‚ LHZB LVL 23.08.2008. 3,80% BlueBay Investment Grade îÓ̉ Ó·ÎË„‡ˆËÈ EUR é·ÎË„‡ˆËË LHZB EUR 15.05.2011. 3,61% ëÓ˜Ì˚È ‰ÂÔÓÁËÚ ‚ DnB Nord Banke LVL 10.12.2008. 3,57% îÓ̉ ÍÓÔÓ‡ÚË‚Ì˚ı Ó·ÎË„‡ˆËÈ T.Rowe Price Eiro EUR 10-ÎÂÚÌË ӷÎË„‡ˆËË ãê LVL 14.02.2013. 3,52% 10-ÎÂÚÌË ӷÎË„‡ˆËË ãê LVL 02.12.2015. 3,38% 3,72% 3,57% ** — Û‰ÂθÌ˚È ‚ÂÒ Í ÌÂÚÚÓ ‡ÍÚË‚‡Ï 뇂ÌÂÌË ͂‡Ú‡Î¸Ì˚ı ÂÁÛθڇÚÓ‚ Ô·̇ ‚ÎÓÊÂÌËÈ ÒÓ Ò‰ÌËÏË ÔÓ͇Á‡ÚÂÎflÏË ÓÚ‡ÒÎË Ç „ÛÔÔ ÍÓÌÒ‚‡ÚË‚Ì˚ı Ô·ÌÓ‚ (Ô·Ì˚, ÔÓÎËÚË͇ ‚ÎÓÊÂÌËÈ ÍÓÚÓ˚ı Ì Ô‰ÛÒχÚË‚‡ÂÚ ‚ÎÓÊÂÌËfl ‚ ‡ÍˆËË) ҉̂Á‚¯ÂÌ̇fl ‰ÓıÓ‰ÌÓÒÚ¸ ‚Ó 2-ÓÏ Í‚‡Ú‡Î 2008 „Ó‰‡ ÒÓÒÚ‡‚Ë· 1,42%. èËÓÒÚ “ëÚ‡·ËθÌÓÒÚË” ÒÓÒÚ‡‚ËÎ 1,16%. ÑÎfl Ó·˙ÂÍÚË‚ÌÓÈ ÓˆÂÌÍË ‰ÓıÓ‰ÌÓÒÚË ‚ÎÓÊÂÌËÈ ‰Îfl ‰Ó΄ÓÒÓ˜Ì˚ı ̇ÍÓÔËÚÂθÌ˚ı ÔÓ‰ÛÍÚÓ‚ (‚Íβ˜‡fl ÔÂÌÒËÓÌÌ˚ Ô·Ì˚) Ò‡‚ÌÂÌË ÂÁÛθڇÚÓ‚ ÂÍÓÏẨÛÂÚÒfl ÔÓ‚Ó‰ËÚ¸ Á‡ ÔÂËÓ‰ ‚ÂÏÂÌË Ì ÏÂÌ „Ó‰‡. ê‡ÒÔ‰ÂÎÂÌË ËÌ‚ÂÒÚˈËÓÌÌÓ„Ó ÔÓÚÙÂÎfl Çˉ˚ ‚ÎÓÊÂÌËÈ ÉÂÓ„‡Ù˘ÂÒÍÓ ‡ÒÔ‰ÂÎÂÌË èӘˠӷÎË„‡ˆËË 42,9% ÑÂÔÓÁËÚ˚ 41,7% ÉÓÒÛ‰‡ÒÚ‚ÂÌÌ˚ ӷÎË„‡ˆËË ãê 11,4% ÑÂÌÂÊÌ˚ Ò‰ÒÚ‚‡ 4,0% ã‡Ú‚Ëfl Ö‚ÓÔ‡*** 62% 38% *** – Á‡ ËÒÍβ˜ÂÌËÂÏ ÇÓÒÚÓ˜ÌÓÈ Ö‚ÓÔ˚ ê‡ÒıÓ‰˚ ̇ ÛÔ‡‚ÎÂÌË Ò‰ÒÚ‚‡ÏË, ÔÓÍ˚‚‡ÂÏ˚ ËÁ ‡ÍÚË‚Ó‚ Ô·̇ ‚ÎÓÊÂÌËÈ àÁ ‡ÍÚË‚Ó‚ Ô·̇ ‚ÎÓÊÂÌËÈ ÔÓÍ˚‚‡˛ÚÒfl ‚ÓÁ̇„‡Ê‰ÂÌË ÛÔ‡‚Îfl˛˘ÂÏÛ Ò‰ÒÚ‚‡ÏË Ë ·‡ÌÍÛ-‰ÂʇÚÂβ, ‡ Ú‡ÍÊ ÔӘˠ‡ÒıÓ‰˚, Ò‚flÁ‡ÌÌ˚Â Ò ‰ÂflÚÂθÌÓÒÚ¸˛ Ô·̇ ‚ÎÓÊÂÌËÈ. é·˘ËÈ Ó·˙ÂÏ ‰‡ÌÌ˚ı ‡ÒıÓ‰Ó‚ ‚ ÓÚ˜ÂÚÌÓÏ Í‚‡Ú‡Î ÒÓÒÚ‡‚ËÎ Ls 38022,96. èÓÎËÚË͇ ‚ÎÓÊÂÌËÈ èÎ‡Ì ÔÓ‚Ó‰ËÚ ÍÓÌÒ‚‡ÚË‚ÌÛ˛ ÔÓÎËÚËÍÛ ‚ÎÓÊÂÌËÈ, Ú‡Í Í‡Í Ò‰ÒÚ‚‡ Ô·̇ ‚Í·‰˚‚‡˛ÚÒfl ‚ ÙË̇ÌÒÓ‚˚ ËÌÒÚÛÏÂÌÚ˚ Ò ÙËÍÒËÓ‚‡ÌÌÓÈ ‰ÓıÓ‰ÌÓÒÚ¸˛. ÇÎÓÊÂÌËfl ‚ ÔÓ‰Ó·Ì˚ ËÌÒÚÛÏÂÌÚ˚ Ò˜ËÚ‡˛ÚÒfl ÏÂÌ ËÒÍÓ‚‡ÌÌ˚ÏË ÔÓ Ò‡‚ÌÂÌ˲ Ò ‚ÎÓÊÂÌËflÏË ‚ ˆÂÌÌ˚ ·Ûχ„Ë Í‡ÔËڇ·.