Динамика + USD

реклама

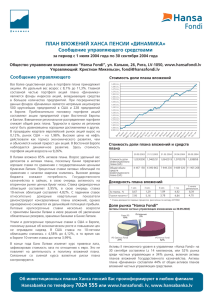

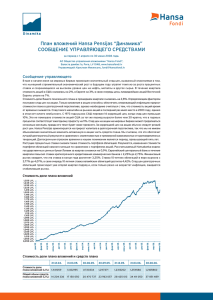

30 ˲Ìfl 2008 „. èÂÌÒËÓÌÌ˚È ÔÎ‡Ì “ÑË̇ÏË͇ + USD” ëÚÂÔÂ̸ ËÒ͇ àÌ‚ÂÒÚˈËÓÌÌ˚ ÔË̈ËÔ˚ àÌ‚ÂÒÚˈËÓÌ̇fl ÔÓÎËÚË͇ è·̇ fl‚ÎflÂÚÒfl Ò·‡Î‡ÌÒËÓ‚‡ÌÌÓÈ, ÔÓÒÍÓθÍÛ Ò‰ÒÚ‚‡ è·̇ ‚Í·‰˚‚‡˛ÚÒfl ‚ ‡ÍˆËË (30% - 60%) Ë ÙË̇ÌÒÓ‚˚ ËÌÒÚÛÏÂÌÚ˚ Ò ÙËÍÒËÓ‚‡ÌÌ˚Ï ‰ÓıÓ‰ÓÏ. LJβڇ Ô·̇ – ‰Óη ëòÄ. ÙÓ̉˚ ‡ÍˆËÈ Òϯ‡ÌÌ˚ ÙÓ̉˚ ÙÓ̉˚ Ó·ÎË„‡ˆËÈ ËÒÍ é·˘Ë ‰‡ÌÌ˚ ìÔ‡‚Îfl˛˘‡fl ÍÓÏÔ‡ÌËfl êÛÍÓ‚Ó‰ËÚÂθ Ô·̇ ÉÓ‰ ÓÒÌÓ‚‡ÌËfl á‡fl‚ÎÂÌËfl ÔËÌËχ˛ÚÒfl AS IPS Hansa Fondi äËÒÚË‡Ì åËÍÂθÒÓÌÒ 2003 ‚ ÙËΡ·ı Aé “Hansabanka” AO “Hansa atklÇtais pensiju fonds” ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ëÚÓËÏÓÒÚ¸ ‡ÍÚË‚Ó‚ Ô·̇ è·ڇ Á‡ ÛÔ‡‚ÎÂÌË USD 1,2454015 USD 812 488 1,25% ÅÓθ¯ÂÈ ÓÊˉ‡ÂÏÓÈ ‰ÓıÓ‰ÌÓÒÚË ÒÓÔÛÚÒÚ‚ÛÂÚ ·ÓΠ‚˚ÒÓÍËÈ ËÒÍ. ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl Ä͈ËË é·ÎË„‡ˆËË ÑÂÔÓÁËÚ˚ ÑÂÌÂÊÌ˚ Ò‰ÒÚ‚‡ ÑË̇ÏË͇ ÒÚÓËÏÓÒÚË ‰ÓÎË Ô·̇ êÓÒÒËfl Ö‚ÓÔ‡**** ÑÛ„‡fl ӷ·ÒÚ¸ ã‡Ú‚Ëfl ÇÓÒÚӘ̇fl Ö‚ÓÔ‡ ëòÄ üÔÓÌËfl 1,35 1,25 1,15 1,05 èËÓÒÚ**, % ÑÓıÓ‰ÌÓÒÚ¸***, % 48,7% 26,4% 8,8% 16,1% ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl ÔÓ ÒÚ‡Ì‡Ï 1,45 0,95 2003 48,7% 26,4% 8,8% 16,1% 3,7% 26,3% 21,7% 24,8% 11,6% 10,4% 1,5% 3,7% 26,3% 21,7% 24,8% 11,6% 10,4% 1,5% **** - ÍÓÏ ÇÓÒÚÓ˜ÌÓÈ Ö‚ÓÔ˚ 2004 2005 2006 2007 Ò Ì‡˜‡Î‡ „Ó‰‡ 1 ÏÂÒflˆ 3 ÏÂÒflˆ‡ 6 ÏÂÒflˆ‡ 1 „Ó‰ 2 „Ó‰‡ Ò ÒÓÁ‰‡ÌËfl* -9,69% -4,87% -0,43% -9,66% -9,31% -9,29% 11,32% 5,50% 25,77% 4,72% * - cÓ ‰Ìfl ÓÒÌÓ‚‡ÌËfl ** - ‰ÓıÓ‰ÌÓÒÚ¸ Ë ÔËÓÒÚ ‡Òc˜ËÚ‡Ì˚ ‰Ó ‡‰ÏËÌ. ÍÓÏËÒÒËË ÓÚÍ˚ÚÓ„Ó ÔÂÌÒËÓÌÌÓ„Ó ÙÓ̉‡ Hansa *** - „Ó‰Ó‚‡fl ÔÓˆÂÌÚ̇fl ÒÚ‡‚͇ ‰ÓıÓ‰ÌÓÒÚË ‡ÒÒ˜Ëڇ̇, ËÒÔÓθÁÛfl Äëí/365 ÏÂÚÓ‰ èÓÚÙÂθ ÔÓ ‚‡Î˛Ú‡Ï GBP EUR***** USD JPY 4,7% 53,3% 40,5% 1,5% 4,7% 53,3% 40,5% 1,5% ***** - ÔÂʉ forward ÑÓıÓ‰ÌÓÒÚ¸, % 2004 2005 2006 2007 5,33% 8,58% 11,42% 8,35% äÓÏÏÂÌÚ‡ËÈ ç‡ ÏËÓ‚˚ı ·Ëʇı ‚ ̇˜‡Î „Ó‰‡ ÍÛÔÌÂȯÂÈ ÔÓ·ÎÂÏÓÈ ·˚ÎË ÌÂÓÊˉ‡ÌÌÓ ÍÛÔÌ˚ ۷˚ÚÍË ·‡ÌÍÓ‚ ëòÄ, ‡ Ú‡ÍÊ ‰Û„Ëı ·‡ÌÍÓ‚, Á‡‚flÁ‡ÌÌ˚ı ̇ ˚ÌÓÍ ‡ÏÂË͇ÌÒÍËı ËÔÓÚ˜Ì˚ı ·Ûχ„ ‚˚ÒÓÍÓ„Ó ËÒ͇. èÓÒΠ‚˚fl‚ÎÂÌËfl ÍÛ„‡ ÔÓ·ÎÂÏ Í ‚Í·‰˜ËÍ‡Ï ‚ÂÌÛ·Ҹ ÔÓÎÓÊËÚÂθ̇fl Û‚ÂÂÌÌÓÒÚ¸ ‚ ‰Ó΄ÓÒÓ˜ÌÓÏ ÓÒÚÂ, Ë Ì‡˜‡ÎÒfl ÒÚÂÏËÚÂθÌ˚È ÔÓ‰˙ÂÏ ˆÂÌ Ì‡ ‡ÍˆËË Ì‡ ÔÓÚflÊÂÌËË ‰‚Ûı ÏÂÒflˆÂ‚ Ò Ï‡Ú‡ ÔÓ Ï‡È, ÍÓ„‰‡ Ë̉ÂÍÒ ˆÂÌ Ì‡ ‡ÍˆËË MSCI World ‚ÓÁÓÒ Ì‡ 11%. ùÚÓÚ ÓÒÚ ˆÂÌ Ì‡ ‡ÍˆËË ËÒÒflÍ Ò ÂÁÍËÏ ÔÓ‚˚¯ÂÌËÂÏ ˆÂÌ Ì‡ ÌÂÙÚ¸, ‚Ó 2-Ï Í‚‡Ú‡Î ÔÓ‰Ìfl‚¯ËıÒfl ̇ 38%, ‡ Á‡ ÔÓÒΉÌË ÚË „Ó‰‡ ÛÚÓË‚¯ËıÒfl. ÇÒΉ Á‡ ÔÓ‰ÓÓʇÌËÂÏ ÚÓÔÎË‚‡ ÔÓ¯ÎË ‚‚Âı ˆÂÌ˚ ̇ ÔÓ‰Ó‚ÓθÒÚ‚ËÂ, Ë ˝ÚÓ ÛÏÂ̸¯ËÎÓ ‚ÓÁÏÓÊÌ˚ ‡ÒıÓ‰˚ ÔÓÚ·ËÚÂÎÂÈ Ì‡ ‰Û„Ë ÌÛʉ˚. ëÌËÊÂÌË ÒÔÓÒ‡ ̇ ÚÓ‚‡˚ ÔÓ‚ÎÂÍÎÓ Á‡ ÒÓ·ÓÈ ÛÏÂ̸¯ÂÌË ÔË·˚ÎË ÍÓÏÔ‡ÌËÈ ‚ ˝ÚÓÏ „Ó‰Û Ë ˆÂÌ Ì‡ ‡ÍˆËË. ë Ò‰ËÌ˚ χfl ‰Ó Ò‰ËÌ˚ ˲Îfl ˆÂÌ˚ ̇ ‡ÍˆËË ÒÌËÁËÎËÒ¸ ̇ 13%, ‚ÂÌÛ‚¯ËÒ¸ Í Ï‡ÚÓ‚ÒÍÓÏÛ ÛÓ‚Ì˛. ç‡ ˚Ì͇ı Ó·ÎË„‡ˆËÈ ËÌÙÎflˆËÓÌÌ˚ ÓÔ‡ÒÂÌËfl ‚˚Á‚‡ÎË ÒÌËÊÂÌË ˆÂÌ Ì‡ Ó·ÎË„‡ˆËË, ˜ÚÓ Ì ÔÓÁ‚ÓÎËÎÓ ‰ÓÒÚ‡ÚÓ˜ÌÓ ÍÓÏÔÂÌÒËÓ‚‡Ú¸ ÒÔ‡‰ ˆÂÌ Ì‡ ‡ÍˆËË. ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ‚ ˝ÚÓÏ Í‚‡Ú‡Î ÒÌËÁË·Ҹ ̇ 0,43%. å˚ ˜‡ÒÚ˘ÌÓ ËÁÏÂÌËÎË ‚Íβ˜ÂÌÌ˚ ‚ ÔÓÚÙÂθ Ô·̇ ÙÓ̉˚ ‡ÍˆËÈ, ҉·‚ ·Óθ¯ËÈ ÛÔÓ Ì‡ ÙÓ̉˚ Ò ‡ÍÚË‚ÌÓÈ ÔÓÎËÚËÍÓÈ ‚˚·Ó‡ ‡ÍˆËÈ Ë ÒÓ͇ÚË‚ Û‰ÂθÌ˚È ‚ˉ Ë̉ÂÍÒÓ‚ ‡ÍˆËÈ. ÅÓθ¯‡fl ˜‡ÒÚ¸ ÔÓÚÙÂÎfl ÔÓ-ÔÂÊÌÂÏÛ ‚ÎÓÊÂ̇ ‚ ‡Á‚ËÚ˚ ˚ÌÍË ‡ÍˆËÈ Ò ˆÂθ˛ ÛÏÂ̸¯ÂÌËfl ËÒ͇ ˚Ì͇ ‡ÍˆËÈ. Ç ÔÓÚÙÂΠӷÎË„‡ˆËÈ Ï˚ ÔÓ‰‰ÂÊË‚‡ÂÏ ÌËÁÍËÈ Û‰ÂθÌ˚È ‚ÂÒ Í‰ËÚÌÓ„Ó ËÒ͇ Ë ÌËÁÍËÈ Û‰ÂθÌ˚È ‚ÂÒ ‰Ó΄ÓÒÓ˜Ì˚ı Ó·ÎË„‡ˆËÈ. äÛÔÌ˚ ËÌ‚ÂÒÚˈËË àÌ‚ÂÒÚˈËfl ÑÓÎfl ëÓ˜Ì˚È ‰ÂÔÓÁËÚ ‚ LHZB 08.08.2008 Pimco ÙÓ̉ e‚oÓ·ÎË„‡ˆËÈ SSGA USA ÙÓ̉ ‡ÍˆËÈ T.Rowe Price ÙÓ̉ Ó·ÎË„‡ˆËÈ ‡Á‚Ë‚‡˛˘ËıÒfl ˚ÌÍÓ‚ SSGA Europe ÙÓ̉ ‡ÍˆËÈ Aviva îÓ̉ Ö‚ÓÔÂÈÒÍËx ‡ÍˆËÈ ÍÓ̂„Â̈ËË GAM Global ÙÓ̉ ‡ÍˆËÈ Wellington Emerging Markets ÙÓ̉ ‡ÍˆËÈ streetTRACKS MSCI Europe ÙÓ̉ ‡ÍˆËÈ Hansa îÓ̉ ÇÓÒÚÓ˜ÌÓ-Ö‚ÓÔÂÈÒÍËı Ó·ÎË„‡ˆËÈ 8,7% 8,7% 6,6% 5,7% 5,5% 5,4% 4,7% 4,4% 4,0% 3,9%