Инвестиционный план Ханса пенсий “Стабильность”

реклама

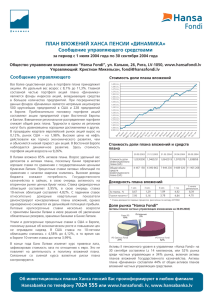

31 χfl 2008 „. àÌ‚ÂÒÚˈËÓÌÌ˚È ÔÎ‡Ì ï‡ÌÒ‡ ÔÂÌÒËÈ “ëÚ‡·ËθÌÓÒÚ¸” ëÚÂÔÂ̸ ËÒ͇ àÌ‚ÂÒÚˈËÓÌÌ˚ ÔË̈ËÔ˚ àÌ‚ÂÒÚˈËÓÌ̇fl ÔÓÎËÚË͇ è·̇ fl‚ÎflÂÚÒfl ÍÓÌÒ‚‡ÚË‚ÌÓÈ, ÔÓÒÍÓθÍÛ Ò‰ÒÚ‚‡ è·̇ ‚Í·‰˚‚‡˛ÚÒfl ‚ ÙË̇ÌÒÓ‚˚ ËÌÒÚÛÏÂÌÚ˚ Ò ÙËÍÒËÓ‚‡ÌÌ˚Ï ‰ÓıÓ‰ÓÏ.Ç ËÌÓÒÚ‡ÌÌ˚ı ‚‡Î˛Ú‡ı, Á‡ ËÒÍβ˜ÂÌËÂÏ Â‚Ó, ‡Á¯‡ÂÚÒfl ‚Í·‰˚‚‡Ú¸ Ì ·ÓΠ30% Ò‰ÒÚ‚ Ô·̇. ÙÓ̉˚ ‡ÍˆËÈ Òϯ‡ÌÌ˚ ÙÓ̉˚ ÙÓ̉˚ Ó·ÎË„‡ˆËÈ ËÒÍ ÅÓθ¯ÂÈ ÓÊˉ‡ÂÏÓÈ ‰ÓıÓ‰ÌÓÒÚË ÒÓÔÛÚÒÚ‚ÛÂÚ ·ÓΠ‚˚ÒÓÍËÈ ËÒÍ. 鷢ˠ‰‡ÌÌ˚ ìÔ‡‚Îfl˛˘‡fl ÍÓÏÔ‡ÌËfl ìÔ‡‚Îfl˛˘ËÈ: ÉÓ‰ ÓÒÌÓ‚‡ÌËfl á‡fl‚ÎÂÌËfl ÔËÌËχ˛ÚÒfl: AS IPS Hansa Fondi äËÒÚË‡Ì åËÍÂθÒÓÌÒ 2002 ‚ ÙËΡ·ı Aé “Hansabanka” www.hanzanet.lv ‚ Ä„ÂÌÒÚ‚Â „ÓÒÛ‰‡ÒÚ‚ÂÌÌÓ„Ó ÒӈˇθÌÓ„Ó ÒÚ‡ıÓ‚‡ÌËfl LVL 1,1582964 LVL 21 299 379 0,59% ëÚÓËÏÓÒÚ¸ ‰ÓÎË Ô·̇ ëÚÓËÏÓÒÚ¸ ‡ÍÚË‚Ó‚ Ô·̇ è·ڇ Á‡ ÛÔ‡‚ÎÂÌË ÑË̇ÏË͇ ÒÚÓËÏÓÒÚË ‰ÓÎË Ô·̇ ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl 1,18 ÑÛ„Ë ӷÎË„‡ˆËË é·ÎË„‡ˆËË ãê ÑÂÔÓÁËÚ˚ ÑÂÌÂÊÌ˚ Ò‰ÒÚ‚‡ 1,13 37,8% 12,6% 41,1% 8,5% 37,8% 12,6% 41,1% 8,5% 1,08 1,03 0,98 2003 èËÓÒÚ, % ÑÓıÓ‰ÌÓÒÚ¸**, % 2004 2005 2006 2007 2008 Ò Ì‡˜‡Î‡ „Ó‰‡ 1 ÏÂÒflˆ 3 ÏÂÒflˆ‡ 6 ÏÂÒflˆ‡ 1 „Ó‰ 3 „Ó‰‡ Ò ÒÓÁ‰‡ÌËfl* 2,63 0,35 1,03 3,11 5,54 5,61 2,77 15,83 2,76 * — cÓ ‰Ìfl ÓÒÌÓ‚‡ÌËfl ** — „Ó‰Ó‚‡fl ÔÓˆÂÌÚ̇fl ÒÚ‡‚͇ ‰ÓıÓ‰ÌÓÒÚË ‡ÒÒ˜Ëڇ̇, ËÒÔÓθÁÛfl Äëí/365 ÏÂÚÓ‰ ÑÓıÓ‰ÌÓÒÚ¸, % ëÚÛÍÚÛ‡ ÔÓÚÙÂÎfl ÔÓ ÒÚ‡Ì‡Ï ã‡Ú‚Ëfl Ö‚ÓÔ‡*** 67,2% 32,8% 67,2% 32,8% *** - Á‡ ËÒÍβ˜ÂÌËÂÏ ÇÓÒÚÓ˜ÌÓÈ Ö‚ÓÔ˚ 2003 2004 2005 2006 2007 3,36 3,62 3,47 -0,76 2,63 äÓÏÏÂÌÚ‡ËÈ äÛÔÌ˚ ËÌ‚ÂÒÚˈËË ëÚÓËÏÓÒÚ¸ ‰ÓÎË ‚‡¯Â„Ó ÔÂÌÒËÓÌÌÓ„Ó Ô·̇ ‚ χ ‚ÓÁÓÒ· ̇ 0,35%. ëÚ‡·ËθÌ˚È Ë ‚˚ÒÓÍËÈ ‰ÓıÓ‰ Ó·ÂÒÔ˜ËÎË ‰ÂÔÓÁËÚ˚ ‚ ·ڇı, ÒÓÒÚ‡‚Îfl˛˘Ë ÓÍÓÎÓ 40% ËÌ‚ÂÒÚˈËÓÌÌÓ„Ó ÔÓÚÙÂÎfl. ë‰Ìflfl ‰ÓıÓ‰ÌÓÒÚ¸ ‰ÂÔÓÁËÚÌÓ„Ó ÔÓÚÙÂÎfl Ò„ӉÌfl ÒÓÒÚ‡‚ÎflÂÚ 8,5% ‚ „Ó‰ (˝ÚÓ ÓÁ̇˜‡ÂÚ, ˜ÚÓ ‚ Ú˜ÂÌË ÏÂÒflˆ‡ ÒÚÓËÏÓÒÚ¸ ˝ÚÓ„Ó ÔÓÚÙÂÎfl Û‚Â΢˂‡ÂÚÒfl ̇ 0,75%), Ӊ̇ÍÓ ÚÂÍÛ˘Ë ‰ÂÔÓÁËÚÌ˚ ÒÚ‡‚ÍË ÔÓ‰ÓÎʇ˛Ú ÒÌËʇڸÒfl, ‰ÓÒÚË„ÌÛ‚ ‚ χ Ò‰ÌÂ„Ó ÛÓ‚Ìfl 6,5% ‚ „Ó‰. чθÌÂȯ ۂÂ΢ÂÌË ۉÂθÌÓ„Ó ‚ÂÒ‡ ‰ÂÔÓÁËÚÌÓ„Ó ÔÓÚÙÂÎfl Ì ̇Ϙ‡ÂÚÒfl Ò ˆÂθ˛ Ó·ÂÒÔ˜ÂÌËfl ‰Ë‚ÂÒËÙˈËÓ‚‡ÌÌÓÈ ÒÚÛÍÚÛ˚ ÔÓÚÙÂÎfl. å˚ ÛÏÂ̸¯‡ÂÏ Û‰ÂθÌ˚È ‚ÂÒ Î‡ÚÓ‚˚ı Ó·ÎË„‡ˆËÈ ‚ ÔÓÚÙÂÎÂ, Ú‡Í Í‡Í ÒÚ‡‚ÍË, ÔÓ ÍÓÚÓ˚Ï ÉÓÒÛ‰‡ÒÚ‚ÂÌÌÓ ͇Á̇˜ÂÈÒÚ‚Ó ÔÓ‰‡ÂÚ ÌÓ‚˚ ӷÎË„‡ˆËË, ÒÎ˯ÍÓÏ ÌËÁÍË ÔÓ Ò‡‚ÌÂÌ˲ Ò ‰ÂÔÓÁËÚÌ˚ÏË ÒÚ‡‚͇ÏË Ë ÛÓ‚ÌÂÏ ËÌÙÎflˆËË. ëÚÓËÏÓÒÚ¸ ÔÓÚÙÂÎfl ·ÚÓ‚˚ı Ó·ÎË„‡ˆËfl ÒÓı‡Ìfl· ÒÚ‡·ËθÌÓÒÚ¸, Ú‡Í Í‡Í Ì‡ÍÓÔÎÂÌÌ˚È ÔÓˆÂÌÚÌ˚È ÔËÓÒÚ Û‡‚Ìӂ¯˂‡ÎÒfl ÔÓÌËÊÂÌÌ˚ÏË ˆÂ̇ÏË. Ç Î‡Ú‡ı ‚ÎÓÊÂÌÓ 60% ÔÓÚÙÂÎfl. éÒڇθ̇fl ˜‡ÒÚ¸ ÔÓÚÙÂÎfl ‚ÎÓÊÂ̇ ‚ ‚˚ÒÓÍÓ͇˜ÂÒÚ‚ÂÌÌ˚ ‚ÓÓ·ÎË„‡ˆËË Ë ÙÓ̉˚ Ó·ÎË„‡ˆËÈ ÌËÁÍÓ„Ó ËÒ͇. ê˚ÌÓ˜Ì˚ ˆÂÌ˚ ̇ Ó·ÎË„‡ˆËË ËÌ‚ÂÒÚˈËÓÌÌÓ„Ó Í·ÒÒ‡ ‚ Â‚Ó ‚ χ ÒÌËÁËÎËÒ¸ ‚ Ò‰ÌÂÏ Ì‡ 1,2%, Ú‡Í Í‡Í ‚ÓÁÓÒÎË ÔÓˆÂÌÚÌ˚ ÒÚ‡‚ÍË, ÓÚ‡ÁË‚ ÓÔ‡ÒÂÌËfl ÔÓ ÔÓ‚Ó‰Û ÓÒÚ‡ ËÌÙÎflˆËË ‚ Ö‚ÓÔÂ. ÉÓ‰Ó‚‡fl ÒÚ‡‚͇ ‰‚ÛıÎÂÚÌËı Ó·ÎË„‡ˆËÈ ÉÂχÌËË ÔÓ‰Ìfl·Ҹ ‰Ó 4,33%, ‚ Ò‚Ó˛ Ә‰¸ „Ó‰Ó‚‡fl ÒÚ‡‚͇ ‰ÓıÓ‰ÌÓÒÚË ‰Ó΄ÓÒÓ˜Ì˚ı Ó·ÎË„‡ˆËÈ ‚ÓÁÓÒ· ÂÁ˜Â, Óڇʇfl ÓÔ‡ÒÂÌËfl, ˜ÚÓ ÓÒÚ ËÌÙÎflˆËË ‚ ÁÓÌÂ Â‚Ó ÏÓÊÂÚ ·˚Ú¸ ‰ÎËÚÂθÌ˚Ï. àÌ‚ÂÒÚˈËfl ÑÓÎfl é·ÎË„‡ˆËË European Investment Bank 15.04.2013 ëÓ˜Ì˚È ‰ÂÔÓÁËÚ ‚ LHZB 23.08.2008 Bluebay Investment Grade Bond Fund TRP Euro Corporate Bond Fund é·ÎË„‡ˆËË LHZB 15.02.2011 ëÓ˜Ì˚È ‰ÂÔÓÁËÚ ‚ DnB Nord 10.12.2008 é·ÎË„‡ˆËË ãê (10 ÎÂÚ) 14.02.2013 é·ÎË„‡ˆËË ãê (10 ÎÂÚ) 02.12.2015 é·ÎË„‡ˆËË Fortis 14.05.2010 é·ÎË„‡ˆËË Nordea Bank AB 27.05.2010 5,0% 4,1% 4,1% 3,9% 3,9% 3,9% 3,8% 3,6% 3,4% 3,4%