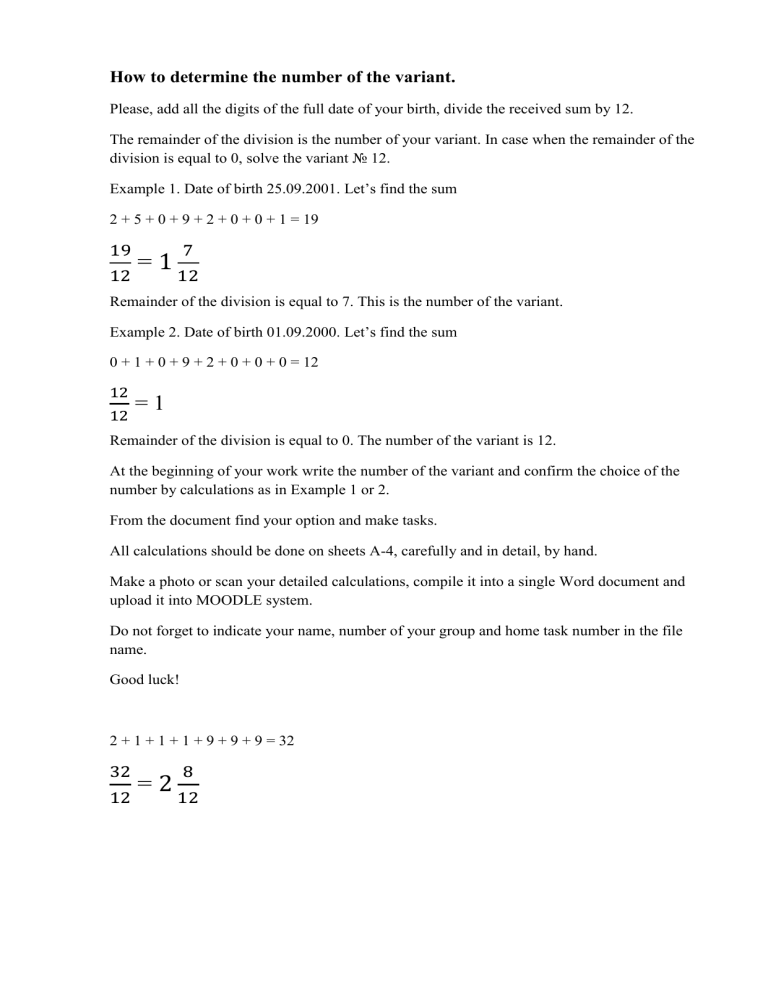

How to determine the number of the variant. Please, add all the digits of the full date of your birth, divide the received sum by 12. The remainder of the division is the number of your variant. In case when the remainder of the division is equal to 0, solve the variant № 12. Example 1. Date of birth 25.09.2001. Let’s find the sum 2 + 5 + 0 + 9 + 2 + 0 + 0 + 1 = 19 19 12 =1 7 12 Remainder of the division is equal to 7. This is the number of the variant. Example 2. Date of birth 01.09.2000. Let’s find the sum 0 + 1 + 0 + 9 + 2 + 0 + 0 + 0 = 12 12 12 =1 Remainder of the division is equal to 0. The number of the variant is 12. At the beginning of your work write the number of the variant and confirm the choice of the number by calculations as in Example 1 or 2. From the document find your option and make tasks. All calculations should be done on sheets A-4, carefully and in detail, by hand. Make a photo or scan your detailed calculations, compile it into a single Word document and upload it into MOODLE system. Do not forget to indicate your name, number of your group and home task number in the file name. Good luck! 2 + 1 + 1 + 1 + 9 + 9 + 9 = 32 32 12 =2 8 12 Variant 1. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 680 Compensation of employees: $430 Indirect taxes less subsidies: $68 Net interest: $470 Gross Private Investment: $760 Government expenditure: $370 Rental income: $170 Net exports: –$125 Corporate profits: $650 Proprietors’ income: $210 Net Investment: $220 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 1992 the Nominal GDP = $98 billion and Real GDP = $110 billion. Calculate the GDP deflator for this economy in 1992. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2002 $145 billion 2003 $148 billion Real GDP (base year $140 billion $136 billion 1998) Calculate the GDP deflator for 2002 and 2003 and also calculate the annual inflation rate in the GDP deflator. Variant 2. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 730 Compensation of employees: $390 Indirect taxes less subsidies: $75 Net interest: $510 Gross Private Investment: $730 Government expenditure: $310 Rental income: $165 Net exports: –$98 Corporate profits: $620 Proprietors’ income: $225 Net Investment: $245 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2001 the Nominal GDP = $120 billion and Real GDP = $135 billion. Calculate the GDP deflator for this economy in 2001. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2004 $ 132billion 2005 $ 137 billion Real GDP (base year $ 129 billion $ 134 billion 1998) Calculate the GDP deflator for 2004 and 2005 and also calculate the annual inflation rate in the GDP deflator. Variant 3. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 940 Compensation of employees: $520 Indirect taxes less subsidies: $93 Net interest: $490 Gross Private Investment: $810 Government expenditure: $420 Rental income: $205 Net exports: –$136 Corporate profits: $580 Proprietors’ income: $240 Net Investment: $370 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 1997 the Nominal GDP = $146 billion and Real GDP = $125 billion. Calculate the GDP deflator for this economy in 1997. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2006 $ 152 billion 2007 $ 155billion Real GDP (base year $ 149 billion $ 148 billion 1998) Calculate the GDP deflator for 2006 and 2007 and also calculate the annual inflation rate in the GDP deflator. Variant 4. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $3 420 Compensation of employees: $610 Indirect taxes less subsidies: $150 Net interest: $503 Gross Private Investment: $805 Government expenditure: $445 Rental income: $190 Net exports: –$210 Corporate profits: $700 Proprietors’ income: $320 Net Investment: $309 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2006 the Nominal GDP = $ 100 billion and Real GDP = $115 billion. Calculate the GDP deflator for this economy in 2006. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2007 $ 126 billion 2008 $ 123 billion Real GDP (base year $ 121 billion $ 119 billion 1998) Calculate the GDP deflator for 2007 and 2008 and also calculate the annual inflation rate in the GDP deflator. Variant 5. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 865 Compensation of employees: $500 Indirect taxes less subsidies: $104 Net interest: $420 Gross Private Investment: $725 Government expenditure: $390 Rental income: $170 Net exports: –$110 Corporate profits: $510 Proprietors’ income: $200 Net Investment: $270 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 1999 the Nominal GDP = $136 billion and Real GDP = $116 billion. Calculate the GDP deflator for this economy in 1999. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2009 $ 118 billion 2010 $ 123 billion Real GDP (base year $ 106 billion $ 105 billion 1998) Calculate the GDP deflator for 2009 and 2010 and also calculate the annual inflation rate in the GDP deflator. Variant 6. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 956 Compensation of employees: $460 Indirect taxes less subsidies: $132 Net interest: $455 Gross Private Investment: $698 Government expenditure: $368 Rental income: $180 Net exports: –$200 Corporate profits: $590 Proprietors’ income: $190 Net Investment: $250 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2002 the Nominal GDP = $96 billion and Real GDP = $105 billion. Calculate the GDP deflator for this economy in 2002. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2011 $ 164 billion 2012 $ 165 billion Real GDP (base year $ 159 billion $ 156 billion 1998) Calculate the GDP deflator for 2011 and 2012 and also calculate the annual inflation rate in the GDP deflator. Variant 7. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 240 Compensation of employees: $370 Indirect taxes less subsidies: $110 Net interest: $475 Gross Private Investment: $680 Government expenditure: $400 Rental income: $180 Net exports: –$240 Corporate profits: $530 Proprietors’ income: $200 Net Investment: $260 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 1994 the Nominal GDP = $128 billion and Real GDP = $104 billion. Calculate the GDP deflator for this economy in 1994. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2001 $ 134 billion 2002 $ 137 billion Real GDP (base $ 128 billion $ 126 billion year1998) Calculate the GDP deflator for 2001 and 2002 and also calculate the annual inflation rate in the GDP deflator. Variant 8. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $3 645 Compensation of employees: $630 Indirect taxes less subsidies: $172 Net interest: $410 Gross Private Investment: $786 Government expenditure: $510 Rental income: $200 Net exports: –$198 Corporate profits: $720 Proprietors’ income: $280 Net Investment: $340 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2010 the Nominal GDP = $95 billion and Real GDP = $118 billion. Calculate the GDP deflator for this economy in 2010. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2012 $ 142 billion 2013 $ 140 billion Real GDP (base year $ 138 billion $ 137 billion 1998) Calculate the GDP deflator for 2012 and 2013 and also calculate the annual inflation rate in the GDP deflator. Variant 9. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 920 Compensation of employees: $475 Indirect taxes less subsidies: $98 Net interest: $420 Gross Private Investment: $710 Government expenditure: $490 Rental income: $190 Net exports: –$180 Corporate profits: $630 Proprietors’ income: $230 Net Investment: $300 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 1998 the Nominal GDP = $125 billion and Real GDP = $97 billion. Calculate the GDP deflator for this economy in 1998. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2014 $ 157 billion 2015 $ 159 billion Real GDP (base year $ 152 billion $ 154 billion 1998) Calculate the GDP deflator for 2014 and 2015 and also calculate the annual inflation rate in the GDP deflator. Variant 10. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 579 Compensation of employees: $385 Indirect taxes less subsidies: $86 Net interest: $460 Gross Private Investment: $657 Government expenditure: $340 Rental income: $130 Net exports: –$175 Corporate profits: $570 Proprietors’ income: $180 Net Investment: $300 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2004 the Nominal GDP = $104 billion and Real GDP = $126 billion. Calculate the GDP deflator for this economy in 2004. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2016 $ 107 billion 2017 $ 110 billion Real GDP (base year $ 105 billion $ 108 billion 1998) Calculate the GDP deflator for 2016 and 2017 and also calculate the annual inflation rate in the GDP deflator. Variant 11. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 798 Compensation of employees: $530 Indirect taxes less subsidies: $106 Net interest: $380 Gross Private Investment: $790 Government expenditure: $520 Rental income: $190 Net exports: –$250 Corporate profits: $500 Proprietors’ income: $250 Net Investment: $350 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2008 the Nominal GDP = $130 billion and Real GDP = $106 billion. Calculate the GDP deflator for this economy in 2008. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2018 $ 161 billion 2019 $ 163 billion Real GDP (base $ 159 billion $ 156 billion year1998) Calculate the GDP deflator for 2018 and 2019 and also calculate the annual inflation rate in the GDP deflator. Variant 12. Theme: Gross Domestic Product and Product Accounts Task 1: Use the following data to work Problems a) and b) The national accounts of Parchment Paradise are kept on (you guessed it) parchment. A fire destroys the statistics office. The accounts are now incomplete but they contain the following data: GDP (expenditure approach): $2 965 Compensation of employees: $600 Indirect taxes less subsidies: $120 Net interest: $520 Gross Private Investment: $790 Government expenditure: $420 Rental income: $176 Net exports: –$240 Corporate profits: $690 Proprietors’ income: $300 Net Investment: $350 a) Calculate National Income and depreciation. b) Calculate GDP (income approach) and the statistical discrepancy. Task 2: In 2012 the Nominal GDP = $102 billion and Real GDP = $132 billion. Calculate the GDP deflator for this economy in 2012. Task 3: We have the following data on nominal GDP and the real GDP for 2002 and 2003: Nominal GDP 2008 $ 117 billion 2009 $ 126 billion Real GDP (base year $ 104 billion $ 110 billion 1998) Calculate the GDP deflator for 2008 and 2009 and also calculate the annual inflation rate in the GDP deflator.