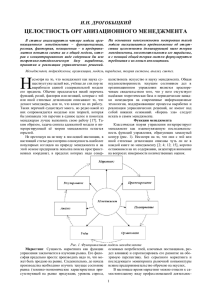

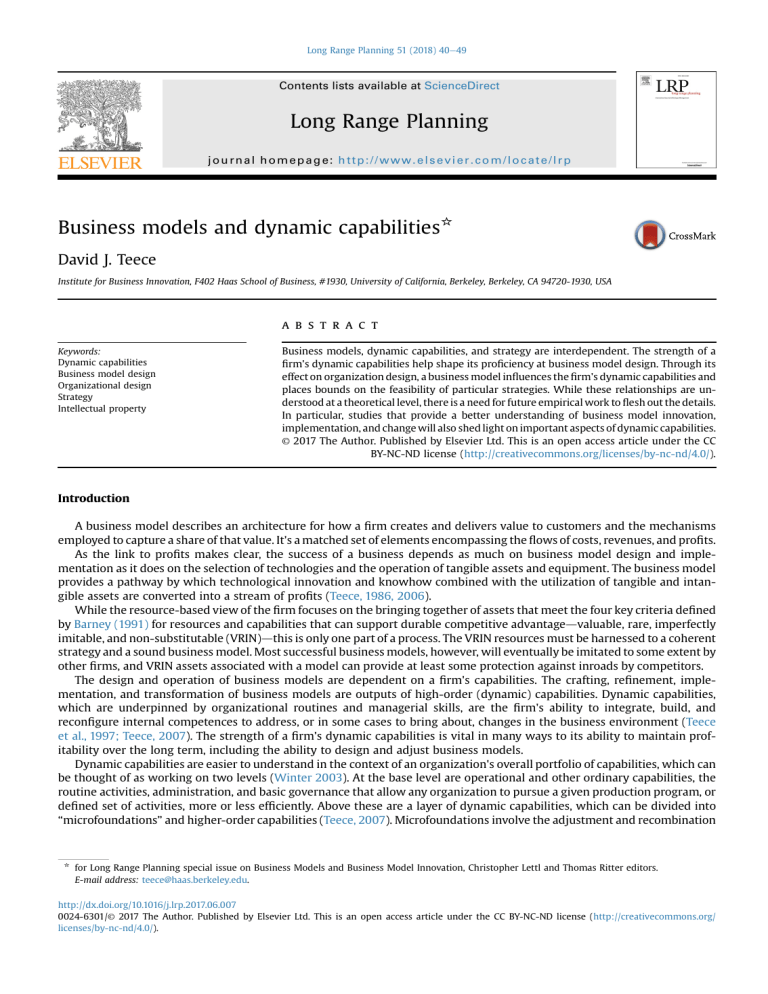

Long Range Planning 51 (2018) 40e49 Contents lists available at ScienceDirect Long Range Planning journal homepage: http://www.elsevier.com/locate/lrp Business models and dynamic capabilities* David J. Teece Institute for Business Innovation, F402 Haas School of Business, #1930, University of California, Berkeley, Berkeley, CA 94720-1930, USA a b s t r a c t Keywords: Dynamic capabilities Business model design Organizational design Strategy Intellectual property Business models, dynamic capabilities, and strategy are interdependent. The strength of a firm's dynamic capabilities help shape its proficiency at business model design. Through its effect on organization design, a business model influences the firm's dynamic capabilities and places bounds on the feasibility of particular strategies. While these relationships are understood at a theoretical level, there is a need for future empirical work to flesh out the details. In particular, studies that provide a better understanding of business model innovation, implementation, and change will also shed light on important aspects of dynamic capabilities. © 2017 The Author. Published by Elsevier Ltd. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). Introduction A business model describes an architecture for how a firm creates and delivers value to customers and the mechanisms employed to capture a share of that value. It's a matched set of elements encompassing the flows of costs, revenues, and profits. As the link to profits makes clear, the success of a business depends as much on business model design and implementation as it does on the selection of technologies and the operation of tangible assets and equipment. The business model provides a pathway by which technological innovation and knowhow combined with the utilization of tangible and intangible assets are converted into a stream of profits (Teece, 1986, 2006). While the resource-based view of the firm focuses on the bringing together of assets that meet the four key criteria defined by Barney (1991) for resources and capabilities that can support durable competitive advantagedvaluable, rare, imperfectly imitable, and non-substitutable (VRIN)dthis is only one part of a process. The VRIN resources must be harnessed to a coherent strategy and a sound business model. Most successful business models, however, will eventually be imitated to some extent by other firms, and VRIN assets associated with a model can provide at least some protection against inroads by competitors. The design and operation of business models are dependent on a firm's capabilities. The crafting, refinement, implementation, and transformation of business models are outputs of high-order (dynamic) capabilities. Dynamic capabilities, which are underpinned by organizational routines and managerial skills, are the firm's ability to integrate, build, and reconfigure internal competences to address, or in some cases to bring about, changes in the business environment (Teece et al., 1997; Teece, 2007). The strength of a firm's dynamic capabilities is vital in many ways to its ability to maintain profitability over the long term, including the ability to design and adjust business models. Dynamic capabilities are easier to understand in the context of an organization's overall portfolio of capabilities, which can be thought of as working on two levels (Winter 2003). At the base level are operational and other ordinary capabilities, the routine activities, administration, and basic governance that allow any organization to pursue a given production program, or defined set of activities, more or less efficiently. Above these are a layer of dynamic capabilities, which can be divided into “microfoundations” and higher-order capabilities (Teece, 2007). Microfoundations involve the adjustment and recombination * for Long Range Planning special issue on Business Models and Business Model Innovation, Christopher Lettl and Thomas Ritter editors. E-mail address: [email protected]. http://dx.doi.org/10.1016/j.lrp.2017.06.007 0024-6301/© 2017 The Author. Published by Elsevier Ltd. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/ licenses/by-nc-nd/4.0/). D.J. Teece / Long Range Planning 51 (2018) 40e49 41 of a firm's existing ordinary capabilities as well as the development of new ones. They are second-order dynamic capabilities that include new product development, expansion into new sales regions, the assignment of product mandates across divisions in large companies, and other actions that constitute astute managerial decision making under uncertainty. Guiding these are the high-order dynamic capabilities by which management, supported by organizational processes, senses likely avenues for the future, devises business models to seize new or changed opportunities, and determines the best configuration for the organization based on its existing form and the new plans for the future. In this paper, I will be referring primarily to the highest-order dynamic capabilities, the sensing, seizing, and transforming competencies that aggregate and direct the various ordinary capabilities and the second-order dynamic capabilities. The highestorder capabilities are those on which top management is (or should be) most focused. They are the most relevant for the innovation and selection of business models that address the problems and opportunities the company is endeavoring to solve/exploit. The paper begins with brief definitions and expositions of business models and dynamic capabilities. This is followed by a discussion that separates business models from strategy and then positions both within the dynamic capabilities framework. Next comes a discussion of the primary interactions between business models and dynamic capabilities: (1) the contribution of dynamic capabilities to business model innovation and (2) the importance of organizational design for both constructs. A concluding section provides a summary and discusses implications for future research. Definitions In this section I will briefly define how I am using the terms business models and dynamic capabilities since there are variations of both terms to be found in the literature. Business models There are almost as many definitions of a business model as there are business models. Several studies have listed or compared various definitions and lists of business model components. See for example Zott et al. (2011) and Birkinshaw and Ansari (2015). My own definition is that a business model … describes the design or architecture of the value creation, delivery, and capture mechanisms [a firm] employs. The essence of a business model is in defining the manner by which the enterprise delivers value to customers, entices customers to pay for value, and converts those payments to profit. (Teece, 2010: 172) In other words, identifying unmet customer needs, specifying the technology and organization that will address them, and, last but by no means least, capturing value from the activities are important functions of the business model. Without the right balance between creation, delivery, and capture, the model will not be in operation very long, at least not by for-profit enterprises. In short, the business model outlines the (industrial) logic by which customers are served and money is made. € n (2012). His schema is similar to that of A compact but fairly comprehensive list of components is provided by Scho Osterwalder and Pigneur (2010) but further compiled into three main categories. Slightly adapted, the list is as follows: Value Proposition: Product & Service; Customer Needs; Geography Revenue Model: Pricing Logic; Channels; Customer Interaction Cost Model: Core Assets & Capabilities; Core Activities; Partner Network The elements of a business model must be internally aligned and coherent (Ritter, 2014). For example, the (ordinary) capabilities of the firm must be able to provide the planned customer value. Furthermore, the business model must be aligned with the internal structure and overall management model of the company (Birkinshaw and Ansari, 2015). In practical terms, this means that extreme business model transitions (those involving a new field of technology, a very different customer base, organizational re-engineering, or some combination of these and other disruptive changes) within an existing business are unlikely to succeed without major financial resources and steely commitment. For example, taxi cab companies are not attempting to replicate the ride-sharing models of Uber or Lyft because those models are based primarily on software and data skills. Taxi companies, by contrast, are small, low-technology enterprises based on long-term contracts with part-time and full-time drivers employing limited information technology in a delimited geographical area and facing (heretofore) restricted competition. Their managerial and organizational resources are unlikely to be able to handle an engineeringand information-driven revamp of the business. At present, it looks like these companies will simply continue to serve the shrinking segment of the market that has not embraced the use of mobile computing for everyday transactions. Their key assets are often locational, such as regulated privileges to occupy taxi stands and airport-pick-up parking set-asides. An old technology often improves with competition from the new, as when sailing ships became “tea clippers” to compete with steamships, but the changes are rarely sufficient to hold back the tides of change without some sort of regulatory barrier to enforce it (Mokyr, 1990). As noted, business model transitions that fit comfortably with the existing business are far easier to implement. Although this rarely suffices to restore a competitive advantage that is under assault, small transitions can enhance value capture. For example, Goldman Sachs was able to increase its business for a complex debt instrument known as structured notes by 42 D.J. Teece / Long Range Planning 51 (2018) 40e49 allowing outside issuers access to financial advisers through a Goldman app (Demos and Hoffman, 2016). While the ability of outside banks to reach clients through Goldman software marks a major change of a business model component (which Goldman can now extend to other financial products), the app grew out of a family of web-based applications that Goldman began to release in 2012. The new app thus built on existing capabilities and offers a superior value proposition. Soon after the app was introduced, Goldman becomes the largest issuer of structured notes where it had previously been only a small player. The various elements of a strategy must be aligned and coherent, and the same is true of the alignment between an organization's strategy and its business model (Rumelt, 2011). Needless to say, the most important alignment for business model implementation is that of company and customer needs in a way that provides the company an ongoing stream of profits. A prime example of this is the “power-by-the-hour” model of jet engines as a service that was pioneered by RollsRoyce in the 1960s (Rolls-Royce, 2012). Instead of paying the high fixed cost of the engine up front, the customer pays only for the hours when the engine is operational. Rolls-Royce has strong incentives to keep the customer's engines in good working order as opposed to the old system in which it was incentivized to sell as many parts and service hours as possible. Meanwhile, the hourly contract enables Rolls-Royce to dampen rivalry from third-party service providers, helping it capture the lucrative service relationship that has always been more profitable than selling the engines themselves. Business models are seldom successful “out of the box” and must be fine-tuneddand sometimes completely overhauleddbefore they can become profit engines. Start-ups generally find transformation easier than do mature firms because they have fewer established assets and procedures to re-engineer. The “lean start-up” model that has spread well beyond Silicon Valley includes the capacity to “pivot”, or, in other words, to quickly test, discard, and replace ideas and business models that do not work (Ries, 2011). This is especially relevant for software-intensive Internet-based business models (where pivoting is relatively easy because much software can be repurposed) and in circumstances where social media can provide fast feedback. Also important to the design of a business model is determining which market segments to target. Good business models will be scalable across multiple segments, but knowing which segment(s) to pursue first is critical. While this is not part of business model design as such, it is part of the marketing strategy that can make a business model successful. Of prime import is how the elements of a business model create (or not) differentiation from competitors in the market. Although many business models, such as Power-by-the-Hour, can be copied by rivals, in practice it may take many years for this to occur. Rivals may calibrate their opportunities differently, and they may lack the organizational adaptability to switch business models. In other words, they may have weaker dynamic capabilities. Meanwhile the pioneer may accrue advantages such as, in the Rolls-Royce example, perfecting the skills required to monitor and maintain jet engines for maximum uptime. Pioneering a new business model is not, however, always a path to advantage. Being first with an imitable business model may teach the customers about the new value proposition, priming the way for entry by rivals without securing any lock-in for the pioneer firm. For example, while containerized shipping was pioneered in the late 1950s by a U.S. shipper later known as Sea-Land Service, the business is today dominated by others. Maersk Line, a rival shipper that waited some twenty years before adopting containerization, was one of the latest adopters yet is now the largest, having acquired Sea-Land in 1999. Maersk was able to wait for standards and technology to mature, then move decisively by building large ships and modern port facilities that it was then able to orchestrate effectively (Pedersen and Sornn-Friese, 2015). The pioneers would have needed to be fast learners and able to scale quickly to capture the lion's share of the available profits. An important distinction is the one between business models that are also “platforms” and those that are not. When platforms and two-sided (or n-sided) markets exist that also have “installed base” characteristics (Katz and Shapiro, 1994), then winner-take-all, or winner-take-the-lion's-share, competition is more likely (Teece, 2013). A current example of a platform with an installed base effect is Uber and its rival clone Lyft. Despite the network effects in Uber's business model, Lyft has been able to hang on because the density of driver and rider networks is so great in larger cities that both of these (incompatible) platforms were able to establish sufficient network size to survive. Uber's business model merits closer inspectiondeven though it is a private company and the strength of its value capture remains a subject of conjecturedbecause it is a leading representative of the new crop of “sharing economy” business models. Table 1 compares the business models of Uber and a traditional taxi cab company. Table 1 Urban ride sharing business model comparison. GPS driver guidance Know exact location and arrival time of vehicle Spend time in vehicle on payment Easy choice of vehicle class Drivers are employees or independent contractors Common procedure across geographies Easy ability to provide feedback on service Can be hailed on the street Customer acquisition aided by: Driver owns or leases car Computer dispatched Payment How company is paid Customer rating of driver Traditional Taxi Uber Optional No Yes No Mixture Locally No Yes Partnerships Mixed Mixed Cash or credit Mixed (revenue and profit split, plus per diems) Difficult and not required Mandatory Yes No Yes Independents Globally Yes No App Yes Yes Cashless (cards only) Revenue split with driver Easy and required D.J. Teece / Long Range Planning 51 (2018) 40e49 43 The differences result in a very different, and generally better, experience for Uber customers and for certain types of drivers. Most importantly, though, Uber's model also brings the company a share of revenue without the need to keep expensive assets on its books. The platform, the driver contracts, and the brand are the key assets, not cars, taxi medallions, or the local street knowledge of the drivers. Uber's corporate strategy is to focus more on how to enter new markets and less on how to expand in existing ones. The latter can happen more or less organically once acceptable driver density is achieved. Uber's technology and business model reflect the concept of the “coherence” of different elements of the business model and strategy. Uber's GPS requirement, for example, provides predictable response time for the customer while facilitating the driver's identification of the customer's location. Similarly, preapproving credit shortens the exit time from the vehicle, improving the experience of customers and drivers, and even of other motorists behind the Uber vehicle. Uber uses technology to establish its bona fides as a car service and to circumvent costly and cumbersome regulation, thereby lowering costs to the customer and the driver. The ease of entry also opens up employment opportunities for drivers from all walks of life. The Uber “app” is of course the linchpin of the business model. It's the (software) platform that automates the logistics and integrates the activities and requests of thousands of drivers and customers in large cities like San Francisco, New York, and London. It also has embedded within it overall fleet and market management. Uber, not the drivers, determines when surge pricing is to be implemented. The Uber business model also demonstrates an important feature of successful business models in that it is selfreinforcing. In cities that did not previously have dense networks of cars for hire, Uber brings the car services to the customer in such an improved manner that some customers see no need to own a car. This has a positive feedback effect because, as the customer base reduces its car ownership, the demand for Uber and similar services goes up. Uber, like Airbnb in the lodging sector, also brings assets already purchased (such as the cars owned by Uber drivers) into more active utilization. The “sharing economy” thus saves on capital. Not surprisingly, firms with Uber-like models have proliferated, though not all have prospered. Wag! (wagwalking.com) is the Uber of dog walking. A firm called Handy follows a similar model for house cleaning. Many market verticals remain to be addressed, all with their own idiosyncrasies, needs, opportunities, and constraints. An Uber-style business model is, in itself, no guarantee of success, nor is there one “right” business model design. Choosing and honing a business model calls on the firm's dynamic capabilities, to be discussed next, and strategic analysis, which will be discussed later on. Dynamic capabilities Dynamic capabilities, as mentioned in the introduction, include the sensing, seizing, and transforming needed to design and implement a business model. They can enable an enterprise to upgrade its ordinary capabilities and direct these, and the capabilities of partners, toward high-payoff endeavors. This requires developing and coordinating, or “orchestrating,” the firm's (and partner firms') resources to address and even shape changes in the marketplace, or the business environment more generally. The strength of a firm's dynamic capabilities determines the speed and degree (and associated cost) of aligning the firm's resourcesdincluding its business model(s)dwith customer needs and aspirations. To achieve this, organizations must be able to continuously sense and seize opportunities, and to periodically transform aspects of the organization and culture so as to be able to proactively reposition to address yet newer threats and opportunities as they arise. Dynamic capabilities are multi-faceted, and firms will not necessarily be strong across all types. A firm might excel at sensing new opportunities but be relatively weak at identifying new business models to exploit them. Or a firm might be good at developing new business models yet be mediocre at implementing and refining them. I will, however, abstract from this here. “Strong dynamic capabilities” will generally mean strong (relative to competitors) in all relevant areas of sensing, seizing, and transforming. An enterprise with strong dynamic capabilities will be able to profitably build and renew resources, assets, and ordinary capabilities, reconfiguring them as needed to innovate and respond to (or bring about) changes in the market. The firm's resources must be orchestrated astutely and coordinated with the activities of partner firms to deliver value to customers. Dynamic capabilities are underpinned in part by organizational routines and processes, the gradual evolution of which is punctuated by non-routine managerial interventions. Although some studies (e.g., Eisenhardt and Martin, 2000) restrict the definition of capabilities to organizational routines and managerial rules, I see this as too restrictive. Setting up an early-stage business model, for example, depends as much on art and intuition as on science and analysis. It is a part of dynamic capabilities that is unlikely to be fully routinized (Teece, 2012). Organizational processes, such as frequent status meetings to evaluate short-term results of a new business model, are helpful, but they are inadequate by themselves to determine the best choices from among the myriad available options. A key element of a firm's dynamic capabilities for seizing new opportunities in most cases will be the managerial competences for devising and refining business models (Teece, 2007). In fact, over the past decade, managerial competences have developed into the sub-field of dynamic managerial capabilities (Helfat and Martin, 2015), of which designing and implementing new business models is an important feature. In the world of the Internet, it may even be the most important feature. Dynamic capabilities are hard for rivals to replicate because they are built on the idiosyncratic characteristics of entrepreneurial managers and the history-honed routines and culture of the organization (Teece, 2014a). In addition, there is the uncertain imitability of a complex system that even those directly involved may not fully understand (Lippman and Rumelt, 1982). Because they are a unique and valuable general-purpose resource, strong dynamic capabilities can serve as a firm 44 D.J. Teece / Long Range Planning 51 (2018) 40e49 foundation for sustainable competitive advantage. This is especially true the more deeply embedded the capabilities are in the organization, and the less they are resident only in the top management team. Business models in the dynamic capabilities framework In addition to defining what a business model is, it is also worth considering what it is not. This section will more carefully distinguish between business models, dynamic capabilities, strategy, and investment decisions. Some definitions of business models (e.g., Chesbrough and Rosenbloom, 2002) incorporate strategy. While strategic analysis is inevitably tied to business model design, I see it as an analytically separate and more detailed exercise (Teece, 2010). A strategy can be defined as “a coherent set of analyses, concepts, policies, arguments, and actions that respond to a highstakes challenge” (Rumelt, 2011: 6). It maps out in broad terms how the company will compete. Strategic analysis leads to the selection of a particular business model, market segments, and a go-to-market approach over others. It often leads to abandoning an old business model for a new one in order to create and maintain a distinct advantage in the marketplace (Casadesus-Masanell and Ricart, 2011). According to Casadesus-Masanell and Ricart (2011: 100): “Strategy has been the primary building block of competitiveness over the past three decades, but in the future, the quest for sustainable advantage may well begin with the business model.” It is perhaps more accurate to say that unique capabilities are the primary building block of firm-level competitiveness because they enable business model design, which is deeply intertwined with strategy. In many cases, corporate strategy dictates business model design. At times, however, the arrival of a new general-purpose technology (e.g., the Internet) opens opportunities for radically new business models to which corporate strategy must then respond. Once in place, a business model shapes strategy inasmuch as it constrains some actions and facilitates others. By determining costs and profitability, a business model impacts the very feasibility of a strategy. In the event of a conflict between strategy and the business model, it falls to top management to determine which of the two should change. The dynamic capabilities frameworkda multidisciplinary model of the firm with dynamic capabilities at its coredreflects this interdependence. A simplified version of the framework, omitting feedback channels such as that between organization design and dynamic capabilities, is shown in Fig. 1. Dynamic capabilities and strategy combine to create and refine a defensible business model, which guides organizational transformation. Ideally, this leads to a level of profits adequate to allow the enterprise to sustain and enhance its capabilities and resources. Dynamic CapabiliƟes SENSE SENS IdenƟfy OpportuniƟes Technological PossibiliƟes SEIZE Buy?Refine Design and Business Model; Commit Resources TTechnology Te chno Development TRANSFORM Realign Structure and R Culture Align n ExisƟ ExisƟng CapabiliƟes AnƟcipate ipate CompeƟtor ReacƟons Ɵons Invest nvest in AddiƟonal CapabiliƟes Defend Intellectual Property Proper Strategy Fig. 1. Simplified schema of dynamic capabilities, business models, and strategy. A granular strategic analysis is necessary to identify ‘isolating mechanisms’ that can be used to prevent the erosion of profits through imitation by rivals (Rumelt, 1984). There are a great many, including patents or trade secrets to protect key knowledge assets, switching costs to promote customer lock-in, and rapid scaling to secure large market share and cost advantages before potential rivals can react. D.J. Teece / Long Range Planning 51 (2018) 40e49 45 No strategy works forever, of course. Taxi cab companies had what they believed was an impregnable defense in the form of a regulatory system that limited the number of cabs in a given region. Yet Uber was able to gain a foothold in many jurisdictions by framing its business as (unregulated) “sharing” rather than car hire. Business model-dynamic capability interactions Business models are enabled by dynamic capabilities in the sense that a dynamically capable organization will be able to rapidly implement, test, and refine new and revised business models. Successful implementation draws on management's architectural design, asset orchestration, and learning functions, which are core dynamic capabilities. At the same time, dynamic capabilities depend in part on the organizational flexibility allowed or denied by business model choices such as whether to outsource the manufacture of a new product or build a factory. This section will focus on two aspects of business model-dynamic capability interaction in more detail. First, the importance of dynamic capabilities for business model innovation. Second, the importance of organizational design for both business models and dynamic capabilities. Business model innovation As mentioned earlier, management's ability to develop and refine business models is a core microfoundation of dynamic capabilities (Teece, 2007). This is just as true for designing the original model as it is for replacing and recombining elements of the model over time. An initial step for the (innovating) enterprise is sensing the existence of customers with unmet needs who are willing and able to pay for a product or service that can rectify their predicament. A successful business model provides a customer solution that can support a price high enough to cover all costs and leave a satisfactory profit. In most cases, the development of such a business model starts with a deep understanding of the customer's predicament (sometimes called user needs) and from familiarity with the dozens of models that exist already. In highly competitive developed economies, it is difficult, but by no means impossible, to invent an entirely new business model. Truly new business models are periodically enabled by technological progress. The Internet induced a great wave of such innovation, with many industries being disintermediated in whole or part by online companies. In an earlier era, the telegraph and the railroads triggered and supported scale and scope (Chandler, 1990). Today, the Internet has enabled new business models that are sometimes orthogonal to scale, allowing niche activities to thrive. But it has also unleashed massive network effects such as when business models employ n-sided markets, like eBay, that connect large but scattered groups of small buyers and small sellers on a global scale (Armstrong, 2006). It takes time for business model innovation to catch up to technological possibilities, perhaps because business models are more context-dependent than technology. A new wave of business model innovation will likely accompany the emergence of the “internet of things” (IOT), in which formerly stand-alone physical objects are given the ability to sense and communicate details of their status and environment. This creates opportunities to meter how customers use a product, which might, for example, enable a model of usage-based rental instead of a one-time sale. Moreover, the availability of massive amounts of data from the sensors distributed throughout the IOT creates a new kind of intellectual capital that can be sold or used as the basis for either internal innovation or an external collaboration. Most “new” (to a given firm) business models will be similar to older ones, involving a permutation or hybridization of existing models. A typical example would be a firm that excels in a particular area of operations e running a restaurant chain, producing branded software, etc. e and leverages its expertise into a services business such as consulting or customization. A video game maker might offer “freemium” versions of games likely to find a mass audience but charge up-front fees for specialized games designed for a niche audience with a high willingness to pay. The opportunities for recombination are virtually endless. Firms are unlikely, however, to choose from the full menu of business models. As a practical matter, the choices depend, in part, on the strength of the firm's dynamic capabilities (Teece et al., 2016). Firms with weaker dynamic capabilities, to the extent that they even recognize a new opportunity, will be more likely to adopt business models that lean on past investments and existing organizational processes. In a firm with strong dynamic capabilities across the board, management has greater freedom to contemplate business models that entail radical shifts of resources or activities. With so many possibilities and pitfalls for creating models, the dynamic capability to mix and “remix” or “orchestrate” business model components or elements into business models that meet the criteria laid out earlier takes on particular salience. In fact, the components of a business model are, if possessed by the enterprise, to some extent a type of organizational asset, albeit one that doesn't appear on anyone's balance sheet (Teece, 2015). € n (2012) introduced earlier suggests how such orchestration would The list of business model components from Scho work. Starting from scratch, it can serve as a checklist for decisions to be taken and alignments to be considered. As adjustments are needed, it enables reconsideration of a business model in modular terms because individual components can potentially be changed while leaving the others alone. Business model components are not perfectly modular, of course, because a change in one will generally entail changes in one or more of the others. A shift of distribution channel, for example, from direct shipments to selling via a third party such as Amazon Marketplace will spur a shift of in-house activities from the shipping function toward supplier monitoring. It will of course also undermine the ability to control the presentation of the brand to the final customer, with potential deleterious consequences. 46 D.J. Teece / Long Range Planning 51 (2018) 40e49 The substitution of business model elements can occur at a more granular level as well. A typical example would be the reversal of a previous make/buy decision. This might entail a move to outsourcing because the advantage from having a particular activity in-house has dissipated over time. Moving from “buy” to “make” might follow the recognition that a previously outsourced activity has gained strategic importance, as was the case with the recent wave of IT “insourcing” by major companies such as GM and Target. There are limits, however, to this “mix and match” metaphor. If substitution and accretion transform a once-simple business model into a complex system, “emergent” properties, which can include unwelcome surprises, are likely (Bennet and Bennet, 2008). Organization, structure, and business model selection a) general Another area where business models intersect with dynamic capabilities is organizational design. The adoption of a particular business model typically places requirements on multiple aspects of an organization (Leih et al., 2015). The rapid implementation and adjustment of new business models require strong dynamic capabilities, including an organization that has been designed and primed to be innovative and flexible. In fact, ensuring that “everyone feels that he or she has not only the right but the obligation to seek out new opportunities and to make them happen” may be “the most important job” of an entrepreneurial manager (McGrath and MacMillan, 2000: 301). Nor is this a one-time job. Organizations tend toward rigidity because the perfecting of existing routines is a more natural goal than devising new ones. To avoid organizational inertia, transformation must be a semi-continuous activity (Agarwal and Helfat, 2009). A business model, once selected, requires management to decide which activities will be owned by the firm and which can be left to complementary firms and outsourcing providers. In these “make or buy” decisions, value capture is the primary concern. Controlling bottleneck assets is critical to capturing value (Teece, 1986, 2006). Activities that are competitively supplied by external providers and from which no special knowledge is likely to be derived should generally be outsourced, provided there are adequate in-house resources to manage the relationship effectively (Cooper et al., 1997). A secondary benefit of working with external suppliers is that it can free up resources and attention for dynamic capabilities-level activities that might otherwise be needed to fine-tune ordinary, operational capabilities. Cloud computing provides a good example. Multiple companies offer infrastructure-as-a-service on a competitive basis. By tapping this resource for non-sensitive computing tasks, companies can free themselves from maintaining their own server farms for noncritical data processing. This allows the company's internal IT resources to be focused on more important activities such as digitizing an existing business or crafting new digital business models. Key business model choices have deep systemic implications for the enterprise, affecting the way it does business. Other decisions are simply investment choices that do not implicate a firm's business model. For instance, a resort that decides to go “off the grid” and supply its own electricity is making a business model choice. Whether this is accomplished by using solar power, wind power, or natural gas is unimportant as it has few implications for the way the business is run, i.e., the way customer value is delivered and priced, although it may affect the resort's ability to brand itself “green.” The point is that the investment choice with respect to the generation source does not change the business model in a fundamental way. Similarly, paying independent commission agents by the hour or by the sale will have different incentive effects, but does not fundamentally impact the way the business is run. Management's leadership skills, another important element in the dynamic capabilities framework (Teece, 2016), are implicated when a new business model represents a major change. Managers must articulate a vision and establish an appropriate organizational culture and an incentive system that will promote organizational identification and loyalty (Augier and Teece, 2009). More generally, an organization's overall design and structure affects both its business model innovation and its dynamic capabilities. Innovation requires an organization that is creative and, in the implementation phase, responsive. In terms of organization design, this typically involves shallow management hierarchies and decentralized authority, although the correct balance between delegation and control can take some time to find (Foss, 2003). The choice of whether work groups are tightly coupled or only loosely aligned can influence the product architectures (e.g., integrated or modular) that the firm is able to support (MacCormack et al., 2012). Similarly, the design of a firm's incentive system and values can reinforce or undermine its dynamic capabilities (Ireland et al., 2009). The organizational design components that can support strong dynamic capabilities and a particular business model will often be complementary. However, this need not be the case. For example, a business model that entails a large investment in specialized manufacturing assets running at high efficiency imposes a rigidity penalty that can undermine the ability of a firm to adapt to changes in its business environment, weakening the economic logic of the investment. b) Intellectual property, organizational structures, and business models A central set of issues in many business model designs relates to the control and use of intellectual property (IP). This was a major theme in Teece (1986). Strong IP rights, by hypothesis, allowed research-based entities to employ licensing as D.J. Teece / Long Range Planning 51 (2018) 40e49 47 a business model, even if a good portion of the upside had to be ceded to the licensee. In particular, licensing was seen as a potentially viable business model when IP rights are strong, building necessary complementary assets is costly, and the time available to execute is short. In Teece (1986, 2006), intellectual property was an independent variable in business model choice. In the dynamic capabilities framework, IP can be a choice variable inasmuch as an incumbent might consider challenging the validity of patents developed by independent inventors. Would-be patent and copyright infringers and trade secret misappropriators might also, to the extent possible, endeavor to shape public policy so as to weaken IP rights. Consider first the dilemma of the independent inventor who has invented outside of any established enterprise that could redirect cash flows to support the implementation of an integrated business model. The independent inventor is typically forced to choose licensing or the sale of IP rights as the business model. A joint venture or alliance can allow an IP-only firm to include (or bundle) existing products or services with its IP. An integrated business model might be feasible in certain cases, such as a purely digital product, or when venture capitalists are willing to fund the necessary investment. To illustrate the above points, one can consider Google. Its revenue model is not to license its IP, except in very special circumstances, but to generate revenue and profits from its IP assets indirectly. In fact, Google's business model involves giving away search services to consumers and earning profits through targeted advertising services, data collection, and the sale of data. This is the “freemium” model discussed in Teece (2010) and has been around for decades. For example, broadcast TV and terrestrial radio, but not satellite radio, have always given away content to viewers and listeners while earning money from advertising. Print newspapers and magazines for a long time employed a hybrid business model where the subscriber pays less than the cost of the printed material while advertisers foot the bill for the difference. Ironically, Google, with so much valuable IP of its own, benefits from weakening the IP of others, consistent with its commercial interests. As Barnett (2016) points out, Google's exposure to the direct and indirect copyright infringement claims of content suppliers provides it with a strong incentive to do what it can to weaken copyright. If it can weaken copyright IP, the royalties it owes are likely to be reduced. More generally, we must recognize that IP rights are not protected well enough to be the sole basis for a robust value capture (appropriability) strategy and business model design. In some cases, inventors, creative entities, and innovators can capture value by using “integration strategies” that internalize the complementary assets needed to capture value. The problem, as mentioned earlier, is that integration strategies require significant investment. The challenge is greater the more “enabling” (i.e., applicable in a range of uses) is an invention or creative work. In the extreme case of a general-purpose technology, the number of application areas (sometimes referred to as “verticals”) is so broad that the degree of value capture occurring is highly limited relative to the value that can be created from it. The more applications that are realized, the fewer the IP owner is able to internalize. Kenneth Arrow, the Nobel economist, puzzled over this business model conundrum more than 50 years ago: Patent royalties are generally so low that the profits from exploiting one's own invention are not appreciably greater than those derived from the use of others' knowledge. It really calls for some explanation, why the firm that has developed the knowledge cannot demand a greater share of the resulting profits (Arrow, 1962, p 355). Fifty years later, Arrow was still faced with the same puzzle: Why is it that royalties are not an equivalent source of revenues? In simple theory, the two should be equivalent. Indeed, if there is heterogeneity in productive efficiency, … then it should generally be more profitable to the innovator to grant a license to a more efficient producer …. I have the impression that licensing is a minor source of revenues (Arrow, 2012, p. 47). The answer would appear to lie in the sheer impossibility for many firms of implementing an integration (or bundled) business model across multiple verticals simultaneously. This truncates the return opportunity for licensors, even if capital markets are well developed. The evaluation, assessment, and coordination problems for a licensor of an enabling technology are simply too great. In part this is due to the bounded rationality of, and the quite limited resources available to, inventors and other creative individuals as well as the costs of covering multiple application areas simultaneously. Suppose for instance, one develops a new technology for drilling through rock and cement and that there are many disparate domains to prove up and apply the technology, such as oil drilling, uranium exploration, cement buildings, bridges, etc. These verticals all require assessment and analysis. Given the limited life of patents (20 years), an individual inventor is unlikely to be able to conquer each and all of these possibilities. Licensing is thus generally required to access complementary assets and capabilities already in place so that an inventor can maximize the time between deployment and a patent's expiration. The value captured from an enabling technology is thus likely to be highly limited relative to the social returns to the innovation. Because the private returns do not reflect their value to society, inventors will underinvest compared to the level that would be socially optimal. An analogous situation occurs when a media company such as a recording studio endeavors to license its content to various geographies and according to different usage rules. Some jurisdictions such as the US and the EU honor and protect copyright. Others do not. The ability to capture value with a licensing model versus, say, a business model that depends on live performances, is quite limited. Often the two must be used together. Clearly, the ability to figure out viable business models and adapt to changing circumstances in multiple contextsdas well as shape the legal and contextual environmentdwill draw on the business enterprise's dynamic capabilities. Having an 48 D.J. Teece / Long Range Planning 51 (2018) 40e49 available repertoire of business models is an asset; being able to select, adapt, and match the business model and the environment is a (dynamic) capability. c) International and multinational aspects The interaction of organizations and business models takes on added dimensions in the case of multinational corporations. Multinationals have greater opportunities than single-country rivals to experiment with different business models and organizational processes in different geographies. They can then transfer validated models to all geographies where they can capture value (Teece, 2014b). Of course, business models (and product offerings) may need to be modified to suit local requirements. In China, for example, Starbucks had to accommodate local preferences by adding more food options and providing larger spaces where groups could sit for long periods (Bolt, 2005). Cross-border innovation can flow in either direction. A low-cost, portable ECG machine developed in 2008 by GE's Indian engineers to serve the needs of patients in remote locations was later introduced in the U.S. market to allow GE to target new customer segments such as primary-care doctors, rural clinics, and visiting nurses (Jana, 2009). All such cross-border transfers and adaptations require sensing, seizing, and flexibility at the local and headquarters levels. Bilateral knowledge flows must also be designed into the organization's character. Business model, dynamic capabilities, and organizational design are mutually interdependent. Summary and implications for future research This paper has highlighted certain important interactions between a firm's business models and its dynamic capabilities. A key theme is that strong dynamic capabilities enable the creation and implementation of effective business models. It was also discussed how the design of the organization influences its dynamic capabilities, hence its business model competences. A good business model, through astute make/buy choices, frees up resources that can be devoted toward developing future business and can help to achieve overall strategic priorities. The strength of a firm's capabilities is implicated when business model changes are translated into organizational transformation. Provided the new business model is not an impossible reach from the existing business, excellent asset orchestration skills are needed to effectively manage new business structures alongside existing operations. Other points that were made along the way include: 1. Good business model design depends as much on art and intuition as it does on science and analysis. 2. Good business model design requires deep knowledge of customer needs and the technological and organizational resources that might meet those needs. 3. All good business models require an understanding of current business models at work in the market. Most new business model designs involve the hybridizations of others. 4. Alignment and coherence is desirable so that the business model elements will be mutually reinforcing. 5. Strategic analysis must be tied to business model design and vice versa. Strategy guides business model design and is also to some extent shaped by it. 6. Business models should be coupled with strategies and assets that make imitation difficult. Imitation will occur sooner or later, and pioneers must be fast learners. 7. Identifying the customer segment(s) to focus on first in order to learn and achieve proof of concept and business model viability is a critical capability. 8. When n-sided markets are involved, getting started early and effectively seeding the n sides is critical. 9. Good business model reengineering skills are an important component of strong dynamic capabilities. They enable proficient seizing. 10. The introduction of new business models into an existing organization is always difficult and may require a separate organizational unit. The objective in this paper has been to provide an overview of the connections among the elements of the economic system by which companies map out pathways to profit. As such, the goal has been to provide a broad overview rather than a set of testable propositions. Nevertheless, these topics offer many potential avenues for future research. Studies that provide a better understanding of business model innovation, implementation, and change will shed light on important aspects of dynamic capabilities. This will be true even if such studies do not explicitly locate themselves within the dynamic capabilities framework. This has been the case, for example, with numerous studies that link “corporate entrepreneurship,” a construct that involves the same recombination of resources as contemplated by the dynamic capabilities framework, to performance (Teece, 2016). Likewise, studies that focus on specific aspects of dynamic capabilities, such as opportunity recognition, entrepreneurialism, or flexibility will illuminate aspects of business model innovation and implementation. These relationships, and their implications for performance, will need to be teased out for years to come. D.J. Teece / Long Range Planning 51 (2018) 40e49 49 Acknowledgment I wish to thank Greg Linden and the editors of this special issue for helpful comments and other assistance. References Agarwal, R., Helfat, C.E., 2009. Strategic renewal of organizations. Organ. Sci. 20 (2), 281e293. Armstrong, M., 2006. Competition in two-sided markets. Rand J. Econ. 37 (3), 668e691. Arrow, K.J., 1962. Comment. In: Nelson, R.R. (Ed.), The Rate and the Direction of Inventive Activity: Economic and Social Factors. Princeton University Press, Princeton, NJ, pp. 353e358. Arrow, K.J., 2012. The economics of inventive activity over fifty years. In: Lerner, J., Stern, S. (Eds.), The Rate and Direction of Inventive Activity Revisited. University of Chicago Press, Chicago, pp. 43e48. Augier, M., Teece, D.J., 2009. Dynamic capabilities and the role of managers in business strategy and economic performance. Organ. Sci. 20 (2), 410e421. Barnett, J.M., 2016. Three quasi-fallacies in the conventional understanding of intellectual property. J. Law, Econ. Policy 12 (1), 1e45. Barney, J.B., 1991. Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99e120. Bennet, A., Bennet, D., 2008. The decision-making process in a complex situation. In: Burstein, F., Holsapple, C.W. (Eds.), Handbook on Decision Support Systems 1. Springer-Verlag, New York, pp. 3e20. Birkinshaw, J., Ansari, S., 2015. Understanding management models: going beyond “what” and “why” to “how” work gets done in organizations. In: Foss, N.J. , Saebi, T. (Eds.), Business Model Innovation: the Organizational Dimension. Oxford University Press, Oxford, pp. 85e103. Bolt, K.M., 2005. Starbucks Adjusts its Formula in China. Seattle Post-Intelligencer. June 15. http://www.seattlepi.com/business/article/Starbucks-adjustsits-formula-in-China-1176089.php (Accessed January 22, 2016). Casadesus-Masanell, R., Ricart, J.E., 2011. How to design a winning business model. Harv. Bus. Rev. 89 (1/2), 100e107. Chandler, A.D., 1990. Scale and Scope: the Dynamics of Industrial Capitalism. Belknap Press, Cambridge, MA. Chesbrough, H., Rosenbloom, R.S., 2002. The role of the business model in capturing value from innovation: evidence from xerox corporation's technology. Industrial Corp. Change 11 (3), 529e555. Cooper, M.C., Lambert, D.M., Pagh, J.D., 1997. Supply chain management: more than a new name for logistics. Int. J. Logist. Manag. 8 (1), 1e14. Demos, T., Hoffman, L., 2016. Goldman Sachs Has a New Model. Apple. wsj.com, October 30. http://www.wsj.com/articles/goldman-sachs-has-a-newmodel-apple-1477863314 (Accessed October 31, 2016). Eisenhardt, K.M., Martin, J.A., 2000. Dynamic capabilities: what are they? Strategic Manag. J. 21 (10e11), 1105e1121. Foss, N.J., 2003. Selective intervention and internal hybrids: interpreting and learning from the rise and decline of the Oticon spaghetti organization. Organ. Sci. 14 (3), 331e334. Helfat, C.E., Martin, J.A., 2015. Dynamic managerial capabilities: review and assessment of managerial impact on strategic change. J. Manag. 41 (5), 1281e1312. Ireland, R.D., Covin, J.G., Donald, F., Kuratko, D.F., 2009. Conceptualizing corporate entrepreneurship strategy. Entrepreneursh. Theory Pract. 33 (1), 19e46. Jana, R., 2009. Innovation Trickles in a New Direction. Bloomberg BusinessWeek. March 11. http://www.bloomberg.com/bw/magazine/content/09_12/ b4124038287365.htm (Accessed January 22, 2016). Katz, M.L., Shapiro, C., 1994. Systems competition and network effects. J. Econ. Perspect. 8 (2), 93e115. Leih, S., Linden, G., Teece, D.J., 2015. Business model innovation and organizational design: a dynamic capabilities perspective. In: Foss, N.J., Saebi, T. (Eds.), Business Model Innovation: the Organizational Dimension. Oxford University Press, Oxford, pp. 24e42. Lippman, S.A., Rumelt, R.P., 1982. Uncertain imitability: an analysis of interfirm differences in efficiency under competition. Bell J. Econ. 13 (2), 418e438. MacCormack, A., Baldwin, C., Rusnak, J., 2012. Exploring the duality between product and organizational architectures: a test of the “mirroring” hypothesis. Res. Policy 41 (8), 1309e1324. McGrath, R.G., MacMillan, I., 2000. The Entrepreneurial Mindset: Strategies for Continuously Creating Opportunity in an Age of Uncertainty. Harvard Business School Press, Boston, MA. Mokyr, J., 1990. The Lever of Riches: Technological Creativity and Economic Progress. Oxford University Press, New York. Osterwalder, A., Pigneur, Y., 2010. Business Model Generation: a Handbook for Visionaries, Game Changers, and Challengers. Wiley, Hoboken, NJ. Pedersen, T., Sornn-Friese, H., 2015. A business model innovation by an incumbent late mover: containerization in maersk line. In: Foss, N.J., Saebi, T. (Eds.), Business Model Innovation: the Organizational Dimension. Oxford University Press, Oxford, pp. 217e239. Ries, E., 2011. The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses. Crown Business, New York. Alignment2 [Alignmentsquared] Ritter, T., 2014. Driving Competitiveness and Growth through Business Model Excellence. CBS Competitiveness Platform, Frederiksberg, Denmark. Rolls-Royce, 2012. Rolls-royce Celebrates 50th Anniversary of Power-by-the-hour. Press Release. October 20. http://www.rolls-royce.com/media/pressreleases/yr-2012/121030-the-hour.aspx (Accessed January 26, 2016). Rumelt, R.P., 1984. Towards a strategic theory of the firm. In: Lamb, R. (Ed.), Competitive Strategic Management. Prentice Hall, Englewood Cliffs, NJ. Rumelt, R.P., 2011. Good Strategy/Bad Strategy: the Difference and Why it Matters. Crown Business, New York. €n, O., 2012. Business model modularityea way to gain strategic flexibility? Control. Manag. 56 (2), 73e78. Scho Teece, D.J., 1986. Profiting from technological innovation: implications for integration, collaboration, licensing and public policy. Res. Policy 15 (6), 285e305. Teece, D.J., 2006. Reflections on profiting from technological innovation. Res. Policy 35 (8), 1131e1146. Teece, D.J., 2007. Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic Manag. J. 28 (13), 1319e1350. Teece, D.J., 2010. Business models, business strategy and innovation. Long. Range Plan. 43 (2), 172e194. Teece, D.J., 2012. Dynamic capabilities: routines versus entrepreneurial action. J. Manag. Stud. 49 (8), 1395e1401. Teece, D.J., 2013. The new managerial economics of firm growth: the role of intangible assets and capabilities. In: Thomas, C.R., Shughart, W.F. (Eds.), The Oxford Handbook of Managerial Economics. Oxford University Press, Oxford, pp. 278e301. Teece, D.J., 2014a. The foundations of enterprise performance: dynamic and ordinary capabilities in an (economic) theory of firms. Acad. Manag. Perspect. 28 (4), 328e352. Teece, D.J., 2014b. A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. J. Int. Bus. Stud. 45 (1), 8e37. Teece, D.J., 2015. Intangible assets and a theory of heterogeneous firms. In: Bounfour, A., Miyagawa, T. (Eds.), Intangibles, Market Failure and Innovation Performance. Springer, New York, pp. 217e239. Teece, D.J., 2016. Dynamic capabilities and entrepreneurial management in large organizations: toward a theory of the (entrepreneurial) firm. Eur. Econ. Rev. 86, 202e216. Teece, D., Peteraf, M., Leih, S., 2016. Dynamic capabilities and organizational agility. Calif. Manag. Rev. 58 (4), 13e35. Teece, D.J., Pisano, G., Shuen, A., 1997. Dynamic capabilities and strategic management. Strategic Manag. J. 18 (7), 509e533. Winter, S.G., 2003. Understanding dynamic capabilities. Strategic Manag. J. 24 (10), 991e995. Zott, C., Amit, R., Massa, L., 2011. The business model: recent developments and future research. J. Manag. 37 (4), 1019e1042.