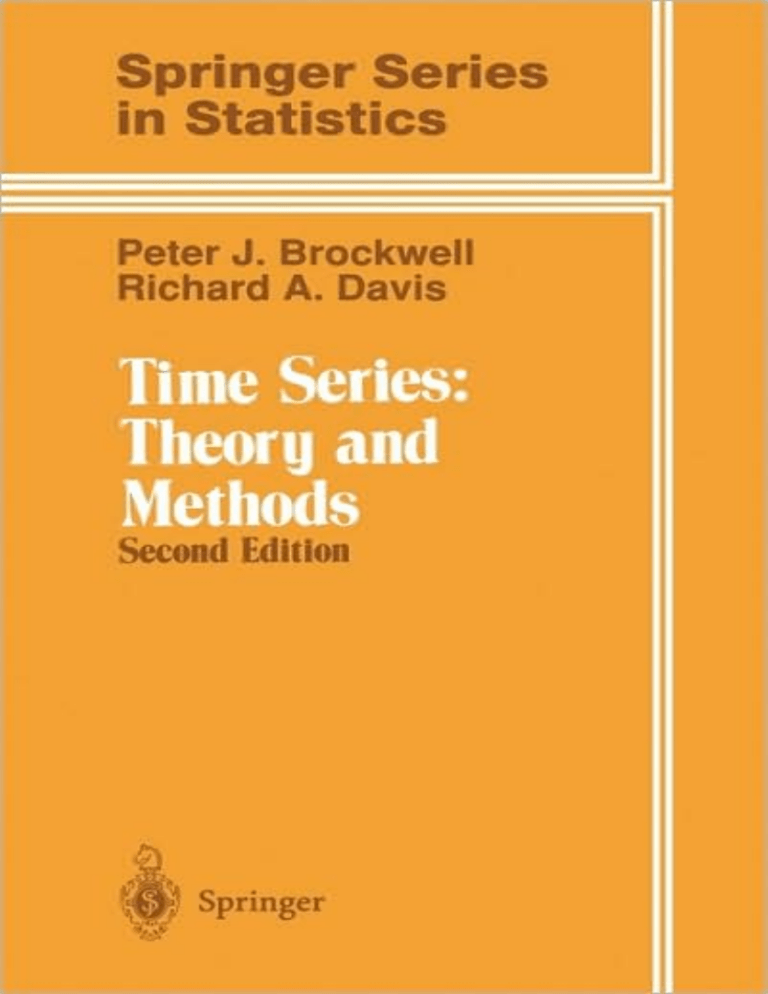

Springer Series in Statistics

Advisors:

P. Bickel, P. Diggle, S. Fienberg, K. Krickeberg,

I. Olkin, N. Wermuth, S. Zeger

For other titles published in this series, go to

http://www.springer.com/series/692

Peter J. Brockwell

Richard A. Davis

Time Series:

Theory and Methods

Second Edition

�Springer

Peter J. Brockwell

Department of Statistics

Colorado State University

Fort Collins, CO 80523

USA

Richard A. Davis

Department of Statistics

Columbia University

New York, NY 10027

USA

Mathematical Subject Classification: 62-01, 62M10

Library of Congress Cataloging-in-Publication Data

Brockwell, Peter J.

Time series: theory and methods I Peter J. Brockwell, Richard A. Davis.

p.

em. -(Springer series in statistics)

"Second edition"-Pref.

Includes bibliographical references and index.

ISBN 0-387-97429-6 (USA).-ISBN 3-540-97429-6 (EUR.)

I. Time-series analysis.

I. Davis, Richard A.

QA280.B76 1991

II. Title.

III. Series.

90-25821

519.5'5-dc20

ISBN 1-4419-0319-8

ISBN 978-1-4419-0319-8

Printed on a.cid-free paper.

(soft cover)

© 2006 Springer Science +Business Media, LLC

All rights reserved. This work may not be translated or copied in whole or in part without the

written permission of the publisher (Springer Science+Business Media, LLC, 233 Spring Street,

New York, NY 10013, USA), except for brief excerpts in connection with reviews or scholarly

analysis. Use in connection with any form of information storage and retrieval, electronic

adaptation, computer software, or by similar or dissimilar methodology now known or hereafter

developed is forbidden.

The use in this publication of trade names, trademarks, service marks, and similar terms, even if

they are not identified as such, is not to be taken as a n expres.sion of opinion as to whether or

not they are subject to proprietary rights.

Printed in the United States of America.

15 14 13

springer.com

To our families

Preface to the Second Edition

This edition contains a large number of additions and corrections scattered

throughout the text, including the incorporation of a new chapter on

state-space models. The companion diskette for the IBM PC has expanded

into the software package I TSM: An Interactive Time Series Modelling

Package for the PC, which includes a manual and can be ordered from

Springer-Verlag. *

We are indebted to many readers who have used the book and programs

and made suggestions for improvements. Unfortunately there is not enough

space to acknowledge all who have contributed in this way; however, sp�cial

mention must be made of our prize-winning fault-finders, Sid Resnick and

F. Pukelsheim. Special mention should also be made of Anthony Brockwell,

whose advice and support on computing matters was invaluable in the

preparation of the new diskettes. We have been fortunate to work on the

new edition in the excellent environments provided by the University of

Melbourne and Colorado State University. We thank Duane Boes

particularly for his support and encouragement throughout, and the

Australian Research Council and National Science Foundation for their

support of research related to the new material. We are also indebted to

Springer-Verlag for their constant support and assistance in preparing the

second edition.

Fort Collins, Colorado

November, 1 990

P.J.

BROCKWELL

R.A. DAVIS

* ITSM: An Interactive Time Series Modelling Package for the PC by P.J. Brockwell a nd R.A.

Da vis. ISBN: 0-387-97482-2; 1991.

viii

Preface to the Second Edition

Note added in the eighth printing: The computer programs referred to in the text

have now been superseded by the package ITSM2000, the student version of which

accompanies our other text, Introduction to Time Series and Forecasting, also

published by Springer-Verlag. Enquiries regarding purchase of the professional

version of this package should be sent to pjbrockwell @cs.com.

Preface to the First Edition

We have attempted in this book to give a systematic account of linear time

series models and their application to the modelling and prediction of data

collected sequentially in time. The aim is to provide specific techniques for

handling data and at the same time to provide a thorough understanding of

the mathematical basis for the techniques. Both time and frequency domain

methods are discussed but the book is written in such a way that either

approach could be emphasized. The book is intended to be a text for graduate

students in statistics, mathematics, engineering, and the natural or social

sciences. It has been used both at the M.S. level, emphasizing the more

practical aspects of modelling, and at the Ph.D. level, where the detailed

mathematical derivations of the deeper results can be included.

Distinctive features of the book are the extensive use of elementary Hilbert

space methods and recursive prediction techniques based on innovations, use

of the exact Gaussian likelihood and AIC for inference, a thorough treatment

of the asymptotic behavior of the maximum likelihood estimators of the

coefficients of univariate ARMA models, extensive illustrations of the tech­

niques by means of numerical examples, and a large number of problems for

the reader. The companion diskette contains programs written for the IBM

PC, which can be used to apply the methods described in the text. Data sets

can be found in the Appendix, and a more extensive collection (including most

of those used for the examples in Chapters 1 , 9, 10, 1 1 and 1 2) is on the diskette.

Simulated ARMA series can easily be generated and filed using the program

PEST. Valuable sources of additional time-series data are the collections of

Makridakis et al. (1984) and Working Paper 109 ( 1984) of Scientific Computing

Associates, DeKalb, Illinois.

Most of the material in the book is by now well-established in the time

series literature and we have therefore not attempted to give credit for all the

X

Preface to the First Edition

results discussed. Our indebtedness to the authors of some of the well-known

existing books on time series, in particular Anderson, Box and Jenkins, Fuller,

Grenander and Rosenblatt,, Hannan, Koopmans and Priestley will however

be apparent. We were also fortunate to have access to notes on time series by

W. Dunsmuir. To these and to the many other sources that have influenced

our presentation of the subject we express our thanks.

Recursive techniques based on the Kalman filter and state-space represen­

tations of ARMA processes have played an important role in many recent

developments in time series analysis. In particular the Gaussian likelihood of

a time series can be expressed very simply in terms of the one-step linear

predictors and their mean squared errors, both of which can be computed

recursively using a Kalman filter. Instead of using a state-space representation

for recursive prediction we utilize the innovations representation of an arbi­

trary Gaussian time series in order to compute best linear predictors and exact

Gaussian likelihoods. This approach, developed by Rissanen and Barbosa,

Kailath, Ansley and others, expresses the value of the series at time t in terms

of the one-step prediction errors up to that time. This representation provides

insight into the structure of the time series itself as well as leading to simple

algorithms for simulation, prediction and likelihood calculation.

These algorithms are used in the parameter estimation program (PEST)

found on the companion diskette. Given a data set of up to 2300 observations,

the program can be used to find preliminary, least squares and maximum

Gaussian likelihood estimators of the parameters of any prescribed ARIMA

model for the data, and to predict future values. It can also be used to simulate

values of an ARMA process and to compute and plot its theoretical auto­

covariance and spectral density functions. Data can be plotted, differenced,

deseasonalized and detrended. The program will also plot the sample auto­

correlation and partial autocorrelation functions of both the data itself and

the residuals after model-fitting. The other time-series programs are SPEC,

which computes spectral estimates for univariate or bivariate series based on

the periodogram, and TRANS, which can be used either to compute and plot

the sample cross-correlation function of two series, or to perform least squares

estimation of the coefficients in a transfer function model relating the second

series to the first (see Section 1 2.2). Also included on the diskette is a screen

editing program (WORD6), which can be used to create arbitrary data files,

and a collection of data files, some of which are analyzed in the book.

Instructions for the use of these programs are contained in the file HELP on

the diskette.

For a one-semester course on time-domain analysis and modelling at the

M.S. level, we have used the following sections of the book :

1 . 1 - 1 .6; 2. 1 -2.7; 3.1 -3.5; 5. 1-5.5; 7. 1 , 7.2; 8.1 -8.9; 9. 1 -9.6

(with brief reference to Sections 4.2 and 4.4). The prerequisite for this course

is a knowledge of probability and statistics at the level ofthe book Introducti on

to the Theory of Stati sti cs by Mood, Graybill and Boes.

Preface to the First Edition

XI

For a second semester, emphasizing frequency-domain analysis and multi­

variate series, we have used

4. 1 -4.4, 4.6-4. 10; 10. 1 - 10.7; 1 1 . 1 - 1 1 .7; selections from Chap. 1 2.

At the M.S. level it has not been possible (or desirable) to go into the mathe­

matical derivation of all the results used, particularly those in the starred

sections, which require a stronger background in mathematical analysis and

measure theory. Such a background is assumed in all of the starred sections

and problems.

For Ph.D. students the book has been used as the basis for a more

theoretical one-semester course covering the starred sections from Chapters

4 through 1 1 and parts of Chapter 1 2. The prerequisite for this course is a

knowledge of measure-theoretic probability.

We are greatly indebted to E.J. Hannan, R.H. Jones, S.l. Resnick, S.Tavare

and D. Tj0stheim, whose comments on drafts of Chapters 1 -8 led to sub­

stantial improvements. The book arose out of courses taught in the statistics

department at Colorado State University and benefitted from the comments

of many students. The development of the computer programs would not have

been possible without the outstanding work of Joe Mandarino, the architect

of the computer program PEST, and Anthony Brockwell, who contributed

WORD6, graphics subroutines and general computing expertise. We are

indebted also to the National Science Foundation for support for the research

related to the book, and one of us (P.J.B.) to Kuwait University for providing

an excellent environment in which to work on the early chapters. For permis­

sion to use the optimization program UNC22MIN we thank R. Schnabel of

the University of Colorado computer science department. Finally we thank

Pam Brockwell, whose contributions to the manuscript went far beyond those

of typist, and the editors of Springer-Verlag, who showed great patience and

cooperation in the final production of the book.

Fort Collins, Colorado

October 1 986

P.J.

BROCKWELL

R.A. DAVIS

Contents

Preface t o the Second Edition

Preface to the First Edition

Vll

IX

CHAPTER I

Stationary Time Series

§1.1

§ 1 .2

§1.3

§ 1 .4

§1.5

§ 1 .6

§1 .7*

Examples o f Time Series

Stochastic Processes

Stationarity and Strict Stationarity

The Estimation and Elimination of Trend and Seasonal Components

The Autocovariance Function of a Stationary Process

The Multivariate Normal Distribution

Applications of Kolmogorov's Theorem

Problems

CHAPTER 2

Hilbert Spaces

Inner-Product Spaces and Their Properties

Hilbert Spaces

The Projection Theorem

Orthonormal Sets

Projection in IR"

Linear Regression and the General Linear Model

Mean Square Convergence, Conditional Expectation and Best

Linear Prediction in L 2(!1, :F, P)

§2.8 Fourier Series

§2.9 Hilbert Space Isomorphisms

§2. 10* The Completeness of L 2 (Q, .?, P)

§2. 1 1 * Complementary Results for Fourier Series

Problems

§2. 1

§2.2

§2.3

§2.4

§2.5

§2.6

§2.7

1

8

11

14

25

32

37

39

42

42

46

48

54

58

60

62

65

67

68

69

73

XIV

Contents

CHAPTER 3

Stationary ARMA Processes

§3.1

§3.2

§3.3

§3.4

§3.5

§3.6*

Causal and Invertible ARMA Processes

Moving Average Processes of I nfinite Order

Computing the Autocovariance Function of an ARMA(p, q) Process

The Partial AutOCfimelation Function

The Autocovariance Generating Function

Homogeneous Linear Difference Equations with

Constant Coefficients

Problems

77

77

89

91

98

1 03

1 05

1 10

CHAPTER 4

The Spectral Representation of a Stationary Process

§4. 1

§4.2

§4.3

§4.4

§4.5*

§4.6*

§4.7*

§4.8 *

§4.9*

§4. 1 0*

§4. 1 1 *

Complex-Valued Stationary Time Series

The Spectral Distribution of a Linear Combination of Sinusoids

Herglotz's Theorem

Spectral Densities and ARMA Processes

Circulants and Their Eigenvalues

Orthogonal Increment Processes on [ -n, n]

Integration with Respect to an Orthogonal Increment Process

The Spectral Representation

Inversion Formulae

Time-Invariant Linear Filters

Properties of the Fourier Approximation h" to J(v.wJ

Problems

1 14

1 14

1 16

1 17

1 22

1 33

1 38

1 40

1 43

1 50

1 52

1 57

1 59

CHAPTER 5

Prediction of Stationary Processes

§5. 1

§5.2

§5.3

§5.4

§5.5

The Prediction Equations in the Time Domain

Recursive Methods for Computing Best Linear Predictors

Recursive Prediction of an ARMA(p, q) Process

Prediction of a Stationary Gaussian Process; Prediction Bounds

Prediction of a Causal Invertible ARMA Process in

Terms of Xi, oo <} :s; n

§5.6* Prediction in the Frequency Domain

§5.7* The Wold Decomposition

§5.8* Kolmogorov's Formula

Problems

-

1 66

1 66

1 69

1 75

1 82

1 82

1 85

1 87

191

1 92

CHAPTER 6*

Asymptotic Theory

§6. 1

§6.2

§6.3

§6.4

Convergence in Probability

Convergence in r'h Mean, r > 0

Convergence in Distribution

Central Limit Theorems and Related Results

Problems

1 98

1 98

202

204

209

215

Contents

XV

CHAPTER 7

Estimation of the Mean and the Autocovariance Function

§7. 1 Estimation of J1

§7.2 Estimation of y( ·) and p( · )

§7.3* Derivation of the Asymptotic Distributions

Problems

218

218

220

225

236

CHAPTER 8

Estimation for ARMA Models

The Yule-Walker Equations and Parameter Estimation for

Autoregressive Processes

§8.2 Preliminary Estimation for Autoregressive Processes Using the

Durbin-Levinson Algorithm

§8.3 Preliminary Estimation for Moving Average Processes Using the

Innovations Algorithm

§8.4 Preliminary Estimation for ARMA(p, q) Processes

§8.5 Remarks on Asymptotic Efficiency

§8.6 Recursive Calculation of the Likelihood of an Arbitrary

Zero-Mean Gaussian Process

§8.7 Maximum Likelihood and Least Squares Estimation for

ARMA Processes

§8.8 Asymptotic Properties of the Maximum Likelihood Estimators

§8.9 Confidence Intervals for the Parameters of a Causal Invertible

ARMA Process

§8. 1 0* Asymptotic Behavior of the Yule-Walker Estimates

§8. 1 1 * Asymptotic Normality of Parameter Estimators

Problems

238

§8. 1

239

241

245

250

253

254

256

258

260

262

265

269

CHAPTER 9

Model Building and Forecasting with ARIMA Processes

§9. 1

§9.2

§9.3

§9.4

§9.5

§9.6

ARIMA Models for Non-Stationary Time Series

Identification Techniques

Order Selection

Diagnostic Checking

Forecasting ARIMA Models

Seasonal ARIMA Models

Problems

273

274

284

301

306

314

320

326

CHAPTER 10

Inference for the Spectrum of a Stationary Process

§10.1

§10.2

§ 1 0.3

§ 10.4

§ 1 0.5

§ 1 0.6

The Periodogram

Testing for the Presence of Hidden Periodicities

Asymptotic Properties of the Periodogram

Smoothing the Periodogram

Confidence Intervals for the Spectrum

Autoregressive, Maximum Entropy, Moving Average and

Maximum Likelihood ARMA Spectral Estimators

§ 1 0.7 The Fast Fourier Transform (FFT) Algorithm

330

331

334

342

350

362

365

373

XVI

Contents

§10.8 * Derivation of the Asymptotic Behavior of the Maximum

Likelihood and Least Squares Estimators of the Coefficients of

an ARMA Process

Problems

CHAPTER II

Multivariate Time Series

§11.1

§1 1 .2

§1 1 .3

§ 1 1 .4

§1 1 . 5

§1 1 .6

§1 1 .7

§1 1 .8 *

Second Order Properties of Multivariate Time Series

Estimation of the Mean and Covariance Function

Multivariate ARMA Processes

Best Linear Predictors of Second Order Random Vectors

Estimation for Multivariate ARMA Processes

The Cross Spectrum

Estimating the Cross Spectrum

The Spectral Representation of a Multivariate Stationary

Time Series

Problems

CHAPTER 12

State-Space Models and the Kalman Recursions

§ 1 2. 1

§ 1 2.2

§ 1 2.3

§12.4

§ 1 2.5

State-Space M odels

The Kalman Recursions

State-Space Models with Missing Observations

Controllability and Observability

Recursive Bayesian State Estimation

Problems

CHAPTER 13

Further Topics

§13. 1

§ 13.2

§ 1 3.3

§13.4

Transfer Function Modelling

Long Memory Processes

Linear Processes with Infinite Variance

Threshold Models

Problems

Appendix: Data Sets

Bibliography

Index

375

396

401

402

405

417

421

430

434

443

454

459

463

463

474

482

489

498

501

506

506

520

535

545

552

555

561

567

CHAPTER 1

Stationary Time Series

In this chapter we introduce some basic ideas of time series analysis and

stochastic processes. Of particular importance are the concepts of stationarity

and the autocovariance and sample autocovariance functions. Some standard

techniques are described for the estimation and removal of trend and season­

ality (of known period) from an observed series. These are illustrated with

reference to the data sets in Section 1 . 1 . Most of the topics covered in this

chapter will be developed more fully in later sections of the book. The reader

who is not already familiar with random vectors and multivariate analysis

should first read Section 1.6 where a concise account of the required

background is given. Notice our convention that an n-dimensional random

vector is assumed (unless specified otherwise) to be a column vector X

(X 1, X2, . . , XnY of random variables. If S is an arbitrary set then we shall use

the notation sn to denote both the set of n-component column vectors with

components in S and the set of n-component row vectors with components

in S.

=

.

§ 1 . 1 Examples of Time Series

A time series is a set of observations x,, each one being recorded at a specified

time t. A discrete-time series (the type to which this book is primarily devoted)

is one in which the set T0 of times at which observations are made is a discrete

set, as is the case for example when observations are made at fixed time

intervals. Continuous-time series are obtained when observations are recorded

continuously over some time interval, e.g. when T0 [0, 1]. We shall use the

notation x(t) rather than x, if we wish to indicate specifically that observations

are recorded continuously.

=

1 . Stationary Time Series

2

EXAMPLE l.l.l (Current Through a Resistor). If a sinusoidal voltage v(t) =

a cos( vt + 8) is applied to a resistor of resistance r and the current recorded

continuously we obtain a continuous time series

x(t) r - 1acos(vt + 8).

=

If observations are made only at times 1 , 2, . . . , the resulting time series will

be discrete. Time series of this particularly simple type will play a fundamental

role in our later study of stationary time series.

0.5

0

-0 5

-1

-1 5

-

2

0

10

20

30

40

50

60

70

80

Figure 1 . 1 . 1 00 observations of the series x(t) = cos(.2t + n/3).

90

1 00

§ 1 . 1 . Examples of Time Series

EXAMPLE

3

1 . 1 .2 (Population x, of the U.S.A., 1 790- 1 980).

x,

x,

1 790

1 800

1 8 10

1 820

1830

1 840

1 850

1 860

1 870

1 880

3,929,21 4

5,308,483

7,239,88 1

9,638,453

1 2,860,702

1 7,063,353

23,1 9 1 ,876

3 1 ,443,321

38,558,371

50,1 89,209

1 890

1 900

1910

1 920

1 930

1940

1 950

1960

1 970

1980

62,979,766

76,21 2, 1 68

92,228,496

1 06,021 ,537

1 23,202,624

1 32, 1 64,569

1 5 1 ,325,798

1 79,323,1 75

203,302,03 1

226,545,805

260

240

220

200

1 80

�

til

c

�

::>

160

1 40

1 20

1 00

80

60

40

40

0

1 78 0

1 830

1 8 80

1 930

1 9 80

Figure 1 .2. Population of the U.S.A. at ten-year intervals, 1 790- 1980 (U.S. Bureau of

the Census).

I. Stationary Time Series

4

EXAMPLE

1 . 1 .3 (Strikes in the U.S.A., 1 95 1 - 1 980).

x,

x,

1951

1952

1953

1954

1955

1956

1957

1958

1 959

1960

1961

1962

1963

1 964

1 965

4737

5117

5091

3468

4320

3825

3673

3694

3708

3333

3367

36 14

3362

3655

3963

1 966

1 967

1 968

1 969

1 970

1 97 1

1 972

1 973

1 974

1 975

1 976

1 977

1 978

1979

1980

4405

4595

5045

5700

571 6

5 1 38

501 0

5353

6074

503 1

5648

5506

4230

4827

3885

6

�

Ill

1J

c

0

Ill

�

0

J:

f.--

5

4

3

2

+-���-,���-.-,����-,��

1950

1955

1 9 60

1 965

1 9 70

1 975

1980

Figure 1 .3. Strikes in the U.S.A., 1 95 1 - 1 980 (Bureau of Labor Statistics, U.S. Labor

Department).

§I. I. Examples of Time Series

EXAMPLE

1 . 1 .4 (All Star Baseball Games, 1 933 - 1 980).

Xt =

t- 1900

x,

5

33

34

35

{

1 if the National League won in year t,

- 1 if the American League won in year t.

37

36

-I -I -I

x,

49

50

-I

I

t- 1900

65

66

t- 1900

x,

51

I

67

t

=no ga me.

*

=two ga mes scheduled.

68

54

55

I

69

40

41

42

43

44

45

46

47

48

56

57

58

59

60

61

62

63

64

I

I

79

80

I - I - I -I

-I

I -I

53

52

39

38

-I

70

71

-I

I -I -I

*

74

75

72

73

*

76

t -I -I -I

*

77

*

78

I

3

2

rp

�9*\

0

GB-!1

-1

�

G-EH3-!t

rk.u

-2

-3

1 930

1 935

1 9 40

1945

1 950

1 955

1 960

1

965

1 970

1 975

1 980

Figure 1 .4. Results x,, Example 1 . 1 .4, of All-star baseball games, 1933 - 1 980.

6

I. Stationary Time Series

EXAMPLE

1 770

1 77 1

1 772

1 773

1 774

1 775

1 776

1 777

1 778

1 779

1 780

1781

1 782

1 783

1 784

1 785

1 786

1 787

1 788

1 789

1 . 1 .5 (Wolfer Sunspot Numbers, 1 770- 1 869).

1 790

1 79 1

1 792

1 793

1 794

1 795

1 796

1 797

1 798

1 799

1 800

1 80 1

1 802

1 803

1 804

1 805

1 806

1 807

1 808

1 809

101

82

66

35

31

7

20

92

1 54

1 25

85

68

38

23

10

24

83

1 32

131

118

90

67

60

47

41

21

16

6

4

7

14

34

45

43

48

42

28

10

8

2

1810

181 1

1812

1813

1814

1815

1816

1817

1818

1 81 9

1 820

1 82 1

1 822

1 823

1 824

1 825

1 826

1 827

1 828

1 829

0

5

12

14

35

46

41

30

24

16

7

4

2

8

17

36

50

62

67

1830

1831

1 832

1 833

1 834

1 835

1 836

1 837

1 838

1 839

1 840

1 84 1

1 842

1 843

1 844

1 845

1 846

1 847

1 848

1 849

71

48

28

8

13

57

1 22

1 38

1 03

86

63

37

24

11

15

40

62

98

1 24

96

1 850

1851

1 852

1 853

1 854

1 855

1 856

1 857

1 858

1 859

1 860

1 86 1

1 862

1 863

1 864

1 865

1 866

1 867

1 868

1 869

66

64

54

39

21

7

4

23

55

94

96

77

59

44

47

30

16

7

37

74

1 6 0 ,-----,

1 50

1 40

1 30

1 20

1 10

1 00

90

80

70

60

50

40

30

20

10

0 �������

1 770

1 780

1 790

1 800

1810

1 8 20

1830

1 840

1 85 0

Figure 1 .5. The Wolfer sunspot numbers, 1 770- 1 869.

1 860

1870

§ 1 . 1 . Examples of Time Series

EXAMPLE

7

1 . 1 .6 (Monthly Accidental Deaths in the U.S.A., 1 973-1 978).

Jan.

Feb.

Mar.

Apr.

May

Jun.

Jul.

Aug.

Sep.

Oct.

Nov.

Dec.

1 973

1 974

1 975

1 976

1 977

1 978

9007

8 1 06

8928

9 1 37

1 00 1 7

1 0826

1 13 1 7

1 0744

97 1 3

9938

9161

8927

7750

698 1

8038

8422

8714

95 1 2

1 0 1 20

9823

8743

9 1 29

8710

8680

8 1 62

7306

8 1 24

7870

9387

9556

1 0093

9620

8285

8433

8 1 60

8034

77 1 7

746 1

7776

7925

8634

8945

1 0078

9 1 79

8037

8488

7874

8647

7792

6957

7726

8 1 06

8890

9299

1 0625

9302

83 1 4

8850

8265

8796

7836

6892

779 1

8 1 29

9115

9434

1 0484

9827

91 10

9070

8633

9240

11

10

"()

c

UJ

�

:J

0

.r:

f--

9

8

7

0

12

24

36

48

60

72

Figure 1.6. Monthly accidental deaths in the U.S.A., 1 973 - 1 978 (National Safety

Council).

8

I. Stationary Time Series

These examples are of course but a few of the multitude of time series to

be found in the fields of engineering, science, sociology and economics. Our

purpose in this book is to study the techniques which have been developed

for drawing inferences from such series. Before we can do this however, it is

necessary to set up a hypothetical mathematical model to represent the data.

Having chosen a model (or family of models) it then becomes possible to

estimate parameters, check for goodness of fit to the data and possibly to use

the fitted model to enhance our understanding of the mechanism generating

the series. Once a satisfactory model has been developed, it may be used

in a variety of ways depending on the particular field of application. The

applications include separation (filtering) of noise from signals, prediction of

future values of a series and the control of future values.

The six examples given show some rather striking differences which are

apparent if one examines the graphs in Figures 1 . 1 - 1 .6. The first gives rise to

a smooth sinusoidal graph oscillating about a constant level, the second to a

roughly exponentially increasing graph, the third to a graph which fluctuates

erratically about a nearly constant or slowly rising level, and the fourth to an

erratic series of minus ones and ones. The fifth graph appears to have a strong

cyclic component with period about 1 1 years and the last has a pronounced

seasonal component with period 12.

In the next section we shall discuss the general problem of constructing

mathematical models for such data.

§ 1.2 Stochastic Processes

The first step in the analysis of a time series is the selection of a suitable

mathematical model (or class of models) for the data. To allow for the possibly

unpredictable nature of future observations it is natural to suppose that each

observation x, is a realized value of a certain random variable X,. The time

series { x" t E T0 } is then a realization of the family of random variables

{ X,, t E T0 }. These considerations suggest modelling the data as a realization

(or part of a realization) of a stochastic process { X,, t E T} where T 2 T0 . To

clarify these ideas we need to define precisely what is meant by a stochastic

process and its realizations. In later sections we shall restrict attention to

special classes of processes which are particularly useful for modelling many

of the time series which are encountered in practice.

Definition 1.2.1 (Stochastic Process). A stochastic process is a family of random

variables {X,, t E T} defined on a probability space (Q, ff, P).

Remark 1. In time series analysis the index (or parameter) set Tis a set of time

points, very often {0, ± 1 , ± 2, . . . }, { 1 , 2, 3, . . . }, [0, oo ) or ( - oo, oo ). Stochastic

processes in which Tis not a subset of IR are also of importance. For example

in geophysics stochastic processes with T the surface of a sphere are used to

§ 1 .2. Stochastic Processes

9

represent variables indexed by their location on the earth's surface. In this

book however the index set T will always be a subset of IR.

Recalling the definition of a random variable we note that for each fixed

t E T, X, is in fact a function X,( . ) on the set n. On the other hand, for each

fixed wEn, X.(w) is a function on T.

(Realizations of a Stochastic Process). The functions

{X.(w), w E!l} on T are known as the realizations or sample-paths of the

process {X,, t E T}.

Definition 1.2.2

Remark 2. We shall frequently use the term time series to mean both the data

and the process of which it is a realization.

The following examples illustrate the realizations of some specific stochastic

processes. The first two could be considered as possible models for the time

series of Examples 1 . 1 . 1 and 1 . 1 .4 respectively.

1 .2. 1 (Sinusoid with Random Phase and Amplitude). Let A and 0

be independent random variables with A :;:::: 0 and 0 distributed uniformly on

(0, 2n). A stochastic process { X (t), t E IR} can then be defined in terms of A and

0 for any given v :;:::: 0 and r > 0 by

( 1 .2. 1 )

X, = r - 1 A cos(vt + 0),

ExAMPLE

o r more explicitly,

X,(w) = r- 1 A(w)cos(vt + 0(w)),

( 1 .2.2)

where w is an element of the probability space n on which A and 0 are defined.

The realizations of the process defined by 1 .2.2 are the functions of t

obtained by fixing w, i.e. functions of the form

x (t) = r- 1 a cos(vt + (}).

The time series plotted in Figure 1 . 1 is one such realization.

EXAMPLE 1 .2.2 (A Binary Process). Let {X,, t = 1, 2, . . . } be a sequence of

independent random variables for each of which

=

( 1 .2.3)

P (X, = 1 ) = P (X, = - 1) l

In this case it is not so obvious as in Example 1 .2. 1 that there exists a

probability space (Q, ff, P) with random variables X 1 , X2 , defined on n

having the required joint distributions, i.e. such that

. • •

( 1 .2.4)

for every n-tuple (i 1 , . . . , in) of 1 's and - 1 's. The existence of such a process is

however guaranteed by Kolmogorov's theorem which is stated below and

discussed further in Section 1 .7.

1 . Stationary Time Series

10

The time series obtained by tossing a penny repeatedly and scoring + 1 for

each head, - I for each tail is usually modelled as a realization of the process

defined by ( 1 .2.4). Each realization of this process is a sequence of 1 's and 1 's.

A priori we might well consider this process as a model for the All Star

baseball games, Example 1 . 1 .4. However even a cursory inspection of the

results from 1 963 onwards casts serious doubt on the hypothesis P(X, 1) = t·

-

=

ExAMPLE 1 .2.3 (Random Walk). The simple symmetric random walk {S, t =

0, I, 2, . . . } is defined in terms of Example 1 .2.2 by S0 = 0 and

t � 1.

( 1 .2.5)

The general random walk is defined in the same way on replacing X 1 , X2 ,

by a sequence of independently and identically distributed random variables

whose distribution is not constrained to satisfy ( 1 .2.3). The existence of such

an independent sequence is again guaranteed by Kolmogorov's theorem (see

Problem 1 . 1 8).

. • •

1 .2.4 (Branching Processes). There is a large class of processes,

known as branching processes, which in their most general form have been

applied with considerable success to the modelling of population growth

(see for example lagers (1 976)). The simplest such process is the Bienayme­

Galton-Watson process defined by the equations X0 = x (the population size

in generation zero) and

ExAMPLE

t = 0, 1, 2,

0 0 0 '

( 1 .2.6)

,j

are independently and identically

where Z,,j, t = 0, I , . . . = 1 , 2,

distributed non-negative integer-valued random variables, Z,,j, representing

the number of offspring of the ph individual born in generation t.

In the first example we were able to define X,(w) quite explicitly for each

t and w. Very frequently however we may wish (or be forced) to specify

instead the collection of all joint distributions of all finite-dimensional vectors

(X, , , X,2, . . . , X,J, t = (t1, . . . , t" ) E T", n E {I, 2, . . . }. In such a case we need

to be sure that a stochastic process (see Definition 1 .2. 1 ) with the specified

distributions really does exist. Kolmogorov's theorem, which we state here

and discuss further in Section 1.7 , guarantees that this is true under minimal

conditions on the specified distribution functions. Our statement of Kolmo­

gorov' s theorem is simplified slightly by the assumption (Remark 1) that T is

a subset of IR and hence a linearly ordered set. If T were not so ordered an

additional "permutation" condition would be required (a statement and proof

of the theorem for arbitrary T can be found in numerous books on probability

theory, for example Lamperti, 1 966).

§ 1 .3. Stationarity and Strict Stationarity

11

Definition 1.2.3 (The Distribution Functions of a Stochastic Process

{X� ' t E Tc !R}). Let 5be the set of all vectors { t = (t 1 , . . . , tn)' E Tn: t 1 <

t 2 < · · · < tn , n = 1 , 2, . . . }. Then the (finite-dimensional) distribution functions

of { X� ' t E T} are the functions { F1 ( ), t E 5} defined for t = (t 1 , , tn)' by

•

• • •

Theorem 1.2.1 (Kolmogorov's Theorem). The probabi li tydi stri buti on functi ons

{ F1( ), t E 5} are the di stri buti on functi ons of some stochasti c process if and

only if for any n E { 1 , 2, . . . }, t = (t 1, . . . , tn)' E 5 and 1 :-:::; i :-:::; n,

•

lim F1(x) = F1< ;>(x(i ))

( 1 .2.8)

wheret (i ) and x(i ) are the (n - I )- component vectors obtai ned by d eleti ng the

i'h components oft and x respecti vely.

If (M · ) is the characteristic function corresponding to F1( ), i.e.

tP1(u) =

l e ;u·xF. (d x 1 , . ,. ,d xn ),

J �n

•

U =

(u 1 , . . . , u n )' E !Rn,

then (1 .2.8) can be restated in the equivalent form,

lim tP1 (u) = tPt(i) (u(i )),

ui-+0

(1 .2.9)

where u(i) is the (n - I )-component vector obtained by deleting the i 1h

component of u.

Condition ( 1 .2.8) is simply the "consistency" requirement that each function

F1( · ) should have marginal distributions which coincide with the specified

lower dimensional distribution functions.

§ 1 .3 Stationarity and Strict Stationarity

When dealing with a finite number of random variables, it is often useful

to compute the covariance matrix (see Section 1 .6) in order to gain insight

into the dependence between them. For a time series {X1 , t E T} we need to

extend the concept of covariance matrix to deal with infinite collections of

random variables. The autocovariance function provides us with the required

extension.

Definition 1.3.1 (The Autocovariance Function). If { X,, t E

T} is a process such

that Var(X1) < oo for each t E T, then the autocovariance function Yx( · , · ) of

{ X1 } is defined by

Yx (r, s) = Cov(X, X. ) = E [(X, - EX, ) (Xs - EX5)],

r, s E T. ( 1 .3.1)

12

I . Stationary Time Series

Definition 1.3.2 (Stationarity). The time series { X0 t E Z }, with index set

Z = {0, ± 1 , ± 2, . . . }, is said to be stationary if

(i) E I X11 2 < oo for all t E Z,

(ii) EX1 =

m

(iii) Yx(r, s)

=

and

for all t E £',

Yx(r + t, s + t) for all r, s, t E £'.

Remark I . Stationarity as just defined is frequently referred to in the literature

as weak stationarity, covariance stationarity, stationarity in the wide sense or

second-order stationarity. For us however the term stationarity, without

further qualification, will always refer to the properties specified by Definition

1 .3.2.

-

Remark 2. If { X1, t E Z } is stationary then Yx(r, s) = Yx(r s, 0) for all r, s E £'. It

is therefore convenient to redefine the autocovariance function of a stationary

process as the function of just one variable,

Yx(h) = Yx(h, 0) = Cov(Xr + h > X1) for all t, h E £'.

The function YxC ) will be referred to as the autocovariance function of { X1}

and Yx(h) as its value at "lag" h. The autocorrelation function (acf) of { X1} is

defined analogously as the function whose value at lag h is

Px(h) = Yx(h)!Yx(O) = Corr(Xr+h> X1) for all t, h E 7L.

It will be noticed that we have defined stationarity only in the case

when T = Z. It is not difficult to define stationarity using a more general index

set, but for our purposes this will not be necessary. If we wish to model a set

of data { X1, t E T c Z } as a realization of a stationary process, we can always

consider it to be part of a realization of a stationary process { X1, t E Z }.

Remark 3.

Another important and frequently used notion of stationarity is introduced

in the following definition.

Definition 1.3.3 (Strict Stationarity). The time series { X0 t E Z } is said to be

strictly stationary if the joint distributions of(X1, , , X1J and (X1, +h , . . . , Xr.+h)'

are the same for all positive integers k and for all t 1, . . . , tk, h E £'.

Strict stationarity means intuitively that the graphs over two equal-length

time intervals of a realization of the time series should exhibit similar statistical

characteristics. For example, the proportion of ordinates not exceeding a

given level x should be roughly the same for both intervals.

• • •

1 .3.3 is equivalent to the statement that (X 1, , Xk)' and

(X l +h ' . . . , Xk+h)' have the same joint distribution for all positive integers k and

integers h.

Remark 4. Definition

• • •

§ 1 .3. Stationarity and Strict Stationarity

13

The Relation Between Stationarity and Strict Stationarity

If { X1 } is strictly stationary it immediately follows, on taking k = 1 in

Definition 1.3.3, that X1 has the same distribution for each t E 7!.. . If E I X1I 2 < oo

this implies in particular that EX1 and Var(X1) are both constant. Moreover,

taking k = 2 in Definition 1 .3.3, we find that Xt+ h and X1 have the same joint

distribution and hence the same covariance for all h E 7!.. . Thus a strictly

stationary process with finite second moments is stationary.

The converse of the previous statement is not true. For example if { X1 } is

a sequence of independent random variables such that X1 is exponentially

distributed with mean one when t is odd and normally distributed with mean

one and variance one when t is even, then { X1} is stationary with Yx(O) = 1

and Yx(h) = 0 for h =F 0. However since X 1 and X2 have different distributions,

{ X1 } cannot be strictly stationary.

There is one important case however in which stationarity does imply strict

stationarity.

Definition 1 .3.4 (Gaussian

Time Series). The process { X1 } is a Gaussian time

series if and only if the distribution functions of { X1} are all multivariate

normal.

If { Xn t E 7!.. } is a stationary Gaussian process then { X1 } is strictly stationary,

since for all n E { 1 , 2, . . . } and for all h, t 1 , t 2 , E Z, the random vectors

(X1, , , X1} and (X1, +h• . . . , X1" +h)' have the same mean and covariance

matrix, and hence the same distribution.

• • •

. . •

1 .3. 1 . Let X1 = A cos(8t) + B sin(8t) where A and B are two uncor­

related random variables with zero means and unit variances with 8 E [ -n, n].

This time series is stationary since

ExAMPLE

Cov(Xr+h• X1) = Cov(A cos(8(t + h)) + B sin(8(t + h)), A cos(8t) + B sin(8t))

=

cos(8t)cos(8(t + h)) + sin(8t)sin(8(t + h))

= cos(8h),

which is independent of t.

EXAMPLE 1 .3.2. Starting with an independent and identically distributed

sequence of zero-mean random variables Z1 with finite variance ai , define

XI = zl + ezt-1· Then the autocovariance function of XI is given by

{

Cov(Xt +h• XI) = Cov(Zt +h + ezt+h- 1 > zl + ezt- 1 )

(1 + 8 2 )al if h = 0,

=

if h = ± 1 ,

8al

if I hi > 1 ,

0

I. Stationary Time Series

14

and hence { X1 } is stationary. In fact it can be shown that { X1 } is strictly

stationary (see Problem 1 . 1 ).

EXAMPLE

1 .3.3. Let

{Y,

if t is even,

x�¥,+ 1 if t is odd.

where { Y, } is a stationary time series. Although Cov(Xr+h• X1)

not stationary for it does not have a constant mean.

=

= yy(h), {

X1 } is

1 .3.4. Referring to Example 1 .2.3, let st be the random walk

X

1

+

X2 + · · · + X, where X 1, X2 , . . . , are independent and identically

S1

distributed with mean zero and variance (J 2 . For h > 0,

t

t +h

Cov(Sr+h • S1) Cov � X; , � Xj

;

j

EXAMPLE

and thus

= (

st

is not stationary.

=

)

(J2 t

Stationary processes play a crucial role in the analysis of time series.

Of course many observed time series (see Section 1 . 1) are decidedly non­

stationary in appearance. Frequently such data sets can be transformed by

the techniques described in Section 1 .4 into series which can reasonably be

modelled as realizations of some stationary process. The theory of stationary

processes (developed in later chapters) is then used for the analysis, fitting and

prediction of the resulting series. In all of this the autocovariance function is

a primary tool. Its properties will be discussed in Section 1.5.

§ 1 .4 The Estimation and Elimination of Trend

and Seasonal Components

The first step in the analysis of any time series is to plot the data. If there are

apparent discontinuities in the series, such as a sudden change of level, it may

be advisable to analyze the series by first breaking it into homogeneous

segments. If there are outlying observations, they should be studied carefully

to check whether there is any justification for discarding them (as for example

if an observation has been recorded of some other process by mistake).

Inspection of a graph may also suggest the possibility of representing the data

as a realization of the process (the "classical decomposition" model),

§1.4. The Estimation and Elimination of Trend and Seasonal Components

X, =

m,

+ s, + r;,

15

( 1 .4. 1)

where m , is a slowly changing function known as a "trend component", s, is

a function with known period d referred to as a "seasonal component", and

r; is a "random noise component" which is stationary in the sense of Definition

1 .3.2. If the seasonal and noise fluctuations appear to increase with the level

of the process then a preliminary transformation of the data is often used to

make the transformed data compatible with the model ( 1 .4. 1). See for example

the airline passenger data, Figure 9.7, and the transformed data, Figure 9.8,

obtained by applying a logarithmic transformation. In this section we shall

discuss some useful techniques for identifying the components in ( 1 .4. 1).

Our aim is to estimate and extract the deterministic components m , and s,

in the hope that the residual or noise component r; will turn out to be a

stationary random process. We can then use the theory of such processes to

find a satisfactory probabilistic model for the process {I; }, to analyze its

properties, and to use it in conjunction with m, and s, for purposes of prediction

and control of {X,}.

An alternative approach, developed extensively by Box and Jenkins ( 1970),

is to apply difference operators repeatedly to the data { x,} until the differenced

observations resemble a realization of some stationary process {Wr }. We can

then use the theory of stationary processes for the modelling, analysis and

prediction of {Wr } and hence of the original process. The various stages of this

procedure will be discussed in detail in Chapters 8 and 9.

The two approaches to trend and seasonality removal, (a) by estimation of

m, and s, in ( 1 .4. 1 ) and (b) by differencing the data { x, }, will now be illustrated

with reference to the data presented in Section 1 . 1 .

Elimination of a Trend i n the Absence of Seasonality

In the absence of a seasonal component the model ( 1 .4. 1 ) becomes

t = 1, . . . , n

where, without loss of generality, we can assume that EI; = 0.

( 1 .4.2)

(Least Squares Estimation of m, ). In this procedure we attempt to

fit a parametric family of functions, e.g.

Method 1

( 1 .4.3)

to the data by choosing the parameters, in this illustration a0, a 1 and a 2 , to

minimize ,L, (x, - m, f .

Fitting a function of the form ( 1 .4.3) to the population data of Figure 1 .2,

1 790 :::::; t :::::; 1 980 gives the estimated parameter values,

llo = 2.0979 1 1 X 1 0 1 0 ,

a1

=

- 2.334962

x

107,

1 . Stationary Time Series

16

260

240

220

200

180

�

Ul

c

0

2-

1 60

1 40

0

1 20

0

1 00

80

60

40

20

0

1 78 0

1 98 0

1 930

188 0

1830

Figure 1 .7. Population of the U.S.A., 1 790- 1 980, showing the parabola fitted by least

squares.

and

a2

=

6.49859 1

x

1 03.

A graph of the fitted function is shown with the original data in Figure 1 .7.

The estimated values of the noise process 1;, 1 790 $; t $; 1 980, are the residuals

obtained by subtraction of m t = ao + a! t + llzt2 from xt.

The trend component m1 furnishes us with a natural predictor of future

values of X1 • For example if we estimate ¥1 990 by its mean value (i.e. zero) we

obtain the estimate,

m1 990 2.484 x 1 08 ,

=

for the population of the U.S.A. in 1 990. However if the residuals { Yr} are

highly correlated we may be able to use their values to give a better estimate

of ¥1 990 and hence of X 1 990 .

Method 2 (Smoothing by Means of a Moving Average). Let q be a non­

negative integer and consider the two-sided moving average,

q

w, = (2q + 1 )- 1

( 1 .4.4)

x+t j•

j=-q

of the process { X1 } defined by ( 1 .4.2). Then for q + 1 $; t $; n q,

q

q

w, = (2q + 1 ) l 2: m+

t

(2q + 1) - l 2: Yr+j

j=-q j +

j=-q

( 1 .4.5)

L

-

-

17

§ 1.4. The Estimation and Elimination of Trend and Seasonal Components

assuming that m, is approximately linear over the interval [t - q, t + q] and

that the average of the error terms over this interval is close to zero.

The moving average thus provides us with the estimates

m, = (2q + W1 j=L-q x,+ j,

q

q

+ 1 ::; t ::; - q.

n

( 1 .4.6)

Since is not observed for t ::; 0 or t > n we cannot use ( 1 .4.6) for t ::; q or

t > n- q. The program SMOOTH deals with this problem by defining

for t < 1 and

n for t > n. The results of applying this

program to the strike data of Figure 1.3 are shown in Figure 1 .8. The

are shown in Figure 1 .9. As expected,

estimated noise terms, Y,

they show no apparent trend.

For any fixed E [0, 1], the one-sided moving averages

t = 1 , . . . , n,

defined by the recursions,

( 1.4.7)

t = 2, . . . , n,

+ (1

and

( 1 .4.8)

can also be computed using the program SMOOTH. Application of ( 1 .4.7)

and ( 1 .4.8) is often referred to as exponential smoothing, since it follows from

a

i + (1 these recursions that, for t :;:o: 2,

, with weights decreasing expo­

weighted moving average of

nentially (except for the last one).

in ( 1 .4.6) as a process obtained from

It is useful to think of

by application of a linear operator or linear filter,

with

X,

X,:= X 1

X,:= X

= X, - m"

a

m, = aX, - a)m,_ 1,

m,,

jX,_ a)'- 1 X 1 ,

m,

=

i��

a(l

a'

L

X,, X,_ 1,

{m,}

m, = L� - co ajx,+ j {X,}

• • .

6

'";)

5

t:,

4

"1J

<:

0

"'

�

0

.r::

3

2 +-������

1975

1980

1955

1960

1965

1970

1950

Figure 1 .8. Simple 5-term moving average m, of the strike data from Figure 1 .3.

I. Stationary Time Series

18

1 ,-------,

0.9

0.8

0.7

0.6

0.5

0.4

0.3

'-;;'

0.2

0

�

:J

0

.r:

0.1

-g

t:.,

0 4-4---+-4-���+-��--���--r--�_,-+--+-�

-0.1

-0.2

-0.3

-0.4

-0.5

-0.6

-0.7

-0.8

-0.9

-1

1950

1955

Figure 1 .9. Residuals, Y,

the strike data.

=

1960

= x,

-

1965

1970

1975

1980

m,, after subtracting the 5-term moving average from

weights aj (2q + 1) - 1 , - q s j s q, and aj = 0, Ul > q. This particular filter

is a "low-pass" filter since it takes the data { x,} and removes from it the rapidly

fluctuating (or high frequency) component { Y,}, to leave the slowly varying

estimated trend term { m,} (see Figure 1 . 1 0).

{x,}

Linea r filter

Figure 1 . 1 0. Smoothing with a low-pass linear filter.

The particular filter ( 1 .4.6) is only one of many which could be used for

smoothing. For large q, provided (2q + 1 ) - 1 2J=-q Y,+i � 0, it will not only

attenuate noise but at the same time will allow linear trend functions m, =

at + b, to pass without distortion. However we must beware of choosing q to

be too large since if m, is not linear, the filtered process, although smooth, will

not be a good estimate of m,. By clever choice of the weights { aj} it is possible

to design a filter which will not only be effective in attenuating noise from the

data, but which will also allow a larger class of trend functions (for example

all polynomials of degree less than or equal to 3) to pass undistorted through

the filter. The Spencer 1 5-point moving average for example has weights

ai = 0,

I ii > 7,

§ 1 .4. The Estimation and Elimination of Trend and Seasonal Components

with

19

I i i :,;; 7,

and

[a0, a1 , ... , a7 ] = 3 i0 [74, 67, 46, 2 1, 3, - 5, - 6, 3]

Applied to the process ( 1 .4.3) with m, =a t 3 + bt2 + ct + d , it gives

7

7

7

a;Xt+i =

a;mt+i +

a; Yr+i

i=-7

i= - 7

i= 7

7

�

aimt+i'

i=-7

-

L

L

L

.

( 1.4.9)

L

-

=mo

where the last step depends on the assumed form of m, (Problem 1 .2). Further

details regarding this and other smoothing filters can be found in Kendall and

Stuart, Volume 3, Chapter 46.

Method 3 (Differencing to Generate Stationary Data). Instead of attempting

to remove the noise by smoothing as in Method 2 , we now attempt to eliminate

the trend term by differencing. We define the first difference operator V by

( 1 .4. 1 0)

VX, =X,- Xt-1 =( 1 - B)X0

where B is the backward shift operator,

( 1 .4. 1 1)

BX, =X,-1·

Powers of the operators B and V are defined in the obvious way, i.e.

Bj (X,) =X,_j and Vj(X,) =V(Vj-1(X,)),j � 1 with V0(X,) =X,. Polynomials

in B and V are manipulated in precisely the same way as polynomial functions

of real variables. For example

=X,- 2X,_1 + X,_z.

If the operator V is applied to a linear trend function m1 =at + b, then we

obtain the constant function Vm, =a. In the same way any polynomial trend

of degree can be reduced to a constant by application of the operator Vk

(Problem 1 .4).

Starting therefore with the model X, =m, + Yr where m, = J=o alj and

Yr is stationary with mean zero, we obtain

VkX, = ak + VkYr,

k

L

k!

a stationary process with mean k!ak. These considerations suggest the

possibility, given any sequence {x,} of data, of applying the operator V

repeatedly until we find a sequence {Vkx,} which can plausibly be modelled

as a realization of a stationary process. It is often found in practice that the

I. Stationary Time Series

20

20

15

10

�

1/l

c

0

i

�

5

0

-5

-10

-15

- 20

1 78 0

1 830

1 880

1 930

1 980

Figure 1 . 1 1 . The twice-differenced series derived from the population data of Figure 1 .2.

order of differencing required is quite small, frequently one or two. (This

depends on the fact that many functions can be well approximated, on an

interval of finite length, by a polynomial of reasonably low degree.)

Applying this technique to the twenty population values { xn, n = 1 , . . . , 20}

of Figure 1 .2 we find that two differencing operations are sufficient to produce

a series with no apparent trend. The differenced data, V2 xn = xn - 2xn - t

xn- z , are plotted in Figure 1 . 1 1 . Notice that the magnitude of the fluctuations

in V2 xn increase with the value of xn - This effect can be suppressed by first

taking natural logarithms, Yn = In xn, and then applying the operator V 2 to

the series { Yn } · (See also Section 9.2(a).)

k

+

Elimination of both Trend and Seasonality

The methods described for the removal of trend can be adapted in a natural

way to eliminate both trend and seasonality in the general model

( 1 .4. 1 2)

where E l; = 0, st + d = S1 and I1= t si = 0. We illustrate these methods, with

reference to the accident data of Example 1 . 1 .6 (Figure 1 .6) for which the

period d of the seasonal component is clearly 1 2.

It will be convenient in Method 1 to index the data by year and month.

= 1, . . . , 1 2 will denote the number ofaccidental deaths

Thus xi. k> j = 1, . . .

,6,k

§ 1 .4. The Estimation and Elimination of Trend and Seasonal Components

reported for the kth month of the/h year, ( 1 972

j = 1' . . .

' 6,

21

+ j). I n other words we define

k = 1 ' . . . ' 1 2.

Method Sl (The Small Trend Method). If the trend is small (as in the accident

data) it is not unreasonable to suppose that the trend term is constant, say mi ,

for the /h year. Since :Lf,:1 sk = 0, we are led to the natural unbiased estimate

while for sk > k

1 12

mj = 1 2 I xj. k>

k=l

=

( 1 .4. 1 3)

1 , . . . , 1 2 we have the estimates,

1 6

( 1 .4. 14)

.sk = Il (xj.k - mJ ,

j=

which automatically satisfy the requirement that :LI,:1 sk = 0. The estimated

error term for month k of the /h year is of course

-6

Y) , k

= x.j, k - mJ - .sk '

j = 1, . . .

, 6,

k = 1 , . . . , 1 2.

( 1 .4. 1 5)

The generalization of( 1 .4.1 3)-( 1 .4. 1 5) to data with seasonality having a period

other than 1 2 should be apparent.

In Figures 1 . 1 2, 1 . 1 3 and 1 . 1 4 we have plotted respectively the detrended

observations xj, k - mi, the estimated seasonal components sk> and the de-

2

�

Vl

u

c

8

:J

0

..c:

f-

0 1-����--����-+--+-----r--H�-

-1

-2

0

12

24

36

48

60

72

Figure 1 . 1 2. Monthly accidental deaths from Figure 1 .6 after subtracting the trend

estimated by Method S l .

1 . Stationary Time Series

22

2

"

D

c

�

��

0

L

,t_

0 4---�--¥+�--�--4---¥+�--�-,M+�

- 1

-2

0

12

24

36

48

60

72

Figure 1 . 1 3. The seasonal component o f the monthly accidental deaths, estimated by

Method S l .

2

Vl

D

c

�

:J

0

L

,t_

0 �����--��rF���

-1

-2

0

12

24

36

48

60

72

Figure 1 . 1 4. The detrended and deseasonalized monthly accidental deaths (Method S l).

§ 1 .4. The Estimation and Elimination of Trend and Seasonal Components

12

23

.-------�

1 1

�

(/)

u

c

0

(/)

:J

0

.J:

t:.

10

9

8

��3EE·r··�·:·�9'*9I'IJCl'crTI:D

7

0

12

24

36

60

48

72

Figure 1 . 1 5. Comparison of the moving average and piecewise constant estimates of

trend for the monthly accidental deaths.

trended, deseasonalized observations �. k = xi. k - mi - sk . The latter have no

apparent trend or seasonality.

Method S2 (Moving Average Estimation). The following technique is preferable

to Method S 1 since it does not rely on the assumption that mr is nearly

constant over each cycle. It is the basis for the "classical decomposition"

option in the time series identification section of the program PEST.

Suppose we have observations {x 1 , . . . , x.}. The trend is first estimated by

applying a moving average filter specially chosen to eliminate the seasonal

component and to dampen the noise. If the period d is even, say d = 2q, then

we use

mt = (0.5Xr - q + Xr - q + l + ' ' ' + Xr+ q - 1 + 0.5Xr+ q )/d,

q<ts

n -

q.

( 1 .4. 1 6)

If the period is odd, say d = 2q + 1, then we use the simple moving average

( 1 .4.6).

In Figure 1 . 1 5 we show the trend estimate mn 6 < t s 66, for the accidental

deaths data obtained from ( 1 .4. 1 6). Also shown is the piecewise constant

estimate obtained from Method S l .

The second step is to estimate the seasonal component. For each k = 1 , . . . , d

we compute the average wk of the deviations { (xk + id - mk +id) : q < k + jd s

n - q}. Since these average deviations do not necessarily sum to zero, we

1 . Stationary Time Series

24

Table 1 . 1 . Estimated Seasonal Components for the Accidental Deaths Data

k

.�, ( Method S 1 )

.�, ( Method S2)

- 744

- 804

2

3

4

5

6

7

8

9

10

11

12

- 1 504

- 1 522

- 724

- 737

- 523

- 526

338

343

808

746

1 665

1 680

96 1

987

- 87

- 1 09

197

258

- 32 1

- 259

- 67

- 57

k

1 , . . . , d,

estimate the seasonal component sk as

=

( 1 .4. 1 7)

and sk = sk -d• > d.

The deseasonalized data is then defined to be the original series with the

estimated seasonal component removed, i.e.

k

t

d, = x, - s,

=

( 1 .4. 1 8)

1 , . . . , n.

Finally we reestimate the trend from { d, } either by applying a moving

average filter as described earlier for non-seasonal data, or by fitting a

polynomial to the series { d, }. The program PEST allows the options of fitting

a linear or quadratic trend m,. The estimated noise terms are then

5;

= - m,

x,

-

t

s, ,

=

1, . . . , n.

The results of applying Methods S l and S2 to the accidental deaths data

are quite similar, since in this case the piecewise constant and moving average

estimates of m, are reasonably close (see Figure 1 . 1 5).

A comparison of the estimates of sk > = 1 , . . . , 1 2, obtained by Methods

S 1 and S2 is made in Table 1 . 1 .

k

Method S3 (Differencing a t Lag d). The technique of differencing which we

applied earlier to non-seasonal data can be adapted to deal with seasonality

of period d by introducing the lag-d difference operator vd defined by

(This operator should not be confused with the operator V

earlier.)

Applying the operator Vd to the model,

X, = m,

where

{ } has period d, we obtain

d

=

d

(1 .4. 1 9)

( 1 - B) defined

+ + Y,,

s,

s,

which gives a decomposition of the difference vdxt into a trend component

- m,_d ) and a noise term ( Y, - Y, - d). The trend, m, - m, _d, can then be

eliminated using the methods already described, for example by application

of some power of the operator V.

Figure 1 . 1 6 shows the result of applying the operator V1 2 to the accidental

(m,

§ 1 .5. The Autocovariance Function of a Stationary Process

25

2

�

Vl

1J

c

0 1-------+-��--����

�:J

0

.r:

s

-

1

-2

0

12

24

Figure 1. 16. The differenced series {V 1 2 x,, t

accidental deaths {x,, t = ! , . . . , 72}.

36

=

48

60

72

1 3, . . . , 72} derived from the monthly

deaths data. The seasonal component evident in Figure 1 .6 is absent from the

graph of V 1 2 x, 1 3 :s:; t :s:; 72. There still appears to be a non-decreasing trend

however. If we now apply the operator V to V 1 2 x, and plot the resulting

differences VV 1 2 x,, t = 14, . . . , 72, we obtain the graph shown in Figure 1 . 1 7,

which has no apparent trend or seasonal component. In Chapter 9 we shall

show that the differenced series can in fact be well represented by a stationary

time series model.

In this section we have discussed a variety of methods for estimating and/or

removing trend and seasonality. The particular method chosen for any given

data set will depend on a number of factors including whether or not estimates

of the components of the series are required and whether or not it appears

that the data contains a seasonal component which does not vary with time.

The program PEST allows two options, one which decomposes the series as

described in Method S2, and the other which proceeds by successive differencing

of the data as in Methods 3 and S3.

§ 1.5 The Autocovariance Function of

a Stationary Process

In this section we study the properties of the autocovariance function intro­

duced in Section 1 .3.

1 . Stationary Time Series

26

2

�

Vl

u

c

��

0

.c

f-

0

�----����+-�

- 1

-2

24

12

0

36

48

60

72

Figure 1 . 1 7. The differenced series {VV 1 2 x,, t = 14, . . . , 7 2 } derived from the monthly

accidental deaths { x, , t = 1, . . , 72}.

.

Proposition 1 .5.1 (Elementary Properties). If y( · ) is the autocovariance function

of a stationary process { X, t E Z}, then

y(O) :;::.: 0,

( 1.5. 1 )

l y(h) l :::;; y(O) for all h E Z,

( 1 .5.2)

y(h) = y( - h) for all h E Z.

(1.5.3)

and y( · ) is even, i.e.

PROOF. The first property is a statement of the obvious fact that Var(X,) :;::>: 0,

the second is an immediate consequence of the Cauchy-Schwarz inequality,

and the third is established by observing that

y( - h) = Cov(X, _h , X,) = Cov(X, X,+ h ) = y(h).

D

Autocovariance functions also have the more subtle property of non­

negative definiteness.

(Non-Negative Definiteness). A real-valued function on the

integers, K : Z --> IR, is said to be non-negative definite if and only if

Definition 1 .5.1

§1 .5. The Autocovariance Function of a Stationary Process

27

( 1 .5.4)

Li,jn=l a;K(t; - ti)ai � 0

for all positive integers n and for all vectors a (a 1 , . . . , a n Y E !Rn and

(t 1, ... , tnY E zn or if and only if Li. i = 1 a; K(i - j)ai � 0 for all such n and a.

t=

=

Theorem 1 .5.1 (Characterization of Autocovariance Functions). A real-valued

function defined on the integers is the autocovariance function of a

stationary time series if and only if it is even and non-negative definite.

PROOF. To show that the autocovariance function y( · ) of any stationary time

E

series {X, } is non-negative definite, we simply observe that if = (a 1 , ,

!Rn , t =

, n E zn , and Z1 = (X,, - EX,, , . . . , X,., - EX,J', then

a

(t 1, ... t )'

=

=

rn [y(t; - ti)]i. i=l

• • •

anY

a'rn a

n

L

i,j=l a;y(t; - ti)ai,

where =

is the covariance matrix of (X, , , . . . , X,).

To establish the converse, let K : Z --> IR be an even non-negative definite

function. We need to show that there exists a stationary process with K( · )

as its autocovariance function, and for this we shall use Kolmogorov's

theorem. For each positive integer n and each t = 1' . .

E z n such that

n

< < · · · < let F1 be the distribution function on !R with characteristic

function

t 1 t2

(t ' tnY

tn ,

.

tP1(u) = exp( - u' Ku/2),

n

where u =

Since K is non-negative

. . . , un Y E !R and K =

definite, the matrix K is also non-negative definite and consequently tPt is

the characteristic function of an n-variate normal distribution with mean

zero and covariance matrix K (see Section 1.6). Clearly, in the notation of

Theorem 1 .2. 1 ,

[K(t;- ti)]i.i=I ·

(u 1 ,

tPt< ;>(u(i)) = lim tP1(u) for each t E Y,

uc-·"" 0

i.e. the distribution functions F1 are consistent, and so by Kolmogorov's

theorem there exists a time series { X, } with distribution functions F1 and

characteristic functions tP1, E Y. In particular the joint distribution of X; and

Xi is bivariate normal with mean 0 and covariance matrix

t

[

K(i - j)

-j) K(O) J '

K(i -j) as required.

K(O)

K(i

which shows that Cov(X; , XJ =

D

I . Stationary Time Series

28

Remark l . As shown in the proof of Theorem 1 .5. 1 , for every autocovariance

function y( · ), there exists a stationary Gaussian time series with y( · ) as its

autocovariance function.

Remark :Z. To verify that a given function is non-negative definite it is sometimes

simpler to specify a stationary process with the given autocovariance function

than to check Definition 1 .5. 1 . For example the function K(h) = cos(Bh), h E Z,

is the autocovariance function of the process in Example 1 .3 . 1 and is therefore

non-negative definite. Direct verification by means of Definition 1 .5.1 however

is more difficult. Another simple criterion for checking non-negative definite­

ness is Herglotz's theorem, which will be proved in Section 4.3.

Remark 3. An autocorrelation function p( ·) has all the properties of an

autocovariance function and satisfies the additional condition p(O) = 1 .

={

ExAMPLE 1 5 1 . Let us show that the real-valued function on Z,

.

.

K(h)

1 if h = 0,

p if h = ± 1 ,

0 otherwise,

is an autocovariance function if and only if I P I � t .

If I p I � i then K ( · ) i s the autocovariance function of the process defined in

Example 1 .3.2 with (J 2 = (1 B 2 r 1 and e = (2pr 1 ( 1 ± j 1 - 4p 2 ).

If p > !, K = [K(i - j)J7, j =t and a is the n-component vector a =

(1, - 1 , 1 , - 1 , . . . )', then

+

a'Ka = n - 2(n - 1)p < 0 for n > 2pj(2p - 1),

which shows that K( · ) is not non-negative definite and therefore, by Theorem

1 .5.1 is not an autocovariance function.

If p < -i, the same argument using the n-component vector

a = (1, 1 , 1 , . . .)' again shows that K( · ) is not non-negative definite.

The Sample Autocovariance Function of an Observed Series

From the observations {x 1 , x 2 , . . . , xn } of a stationary time series { Xr } we

frequently wish to estimate the autocovariance function y( · ) of the underlying

process { Xr } in order to gain information concerning its dependence structure.

This is an important step towards constructing an appropriate mathematical

model for the data. The estimate of y( · ) which we shall use is the sample

autocovariance function.

Definition 1 .5.2. The sample autocovariance function of { x 1 , . . . , xn } is defined

by

§1 .5. The Autocovariance Function of a Stationary Process

n -h

P (h) := n -1 j=I (xj +h - x)(xj - x),

1

and

0 :<::;

29

h < n,

y(h) = y( - h), - n < h :-:::; 0, where .X is the sample mean .X = n - 1 I'i= 1 xi .

Remark 4. The divisor n is used rather than (n - h) since this ensures that the

matrix f" := [y(i - j)J7. j= 1 is non-negative definite (see Section 7.2).

Remark 5. The sample autocorrelation function is defined in terms of the

sample autocovariance function as

l h l < n.

p(h) : = y(h)/Y (O),

The corresponding matrix Rn := [p(i - j)J7. i= 1 is then also non-negative

definite.

Remark 6. The large-sample properties of the estimators

discussed in Chapter 7.

y(h) and p(h) are

1 .5.2. Figure 1 . 1 8(a) shows 300 simulated observations of the series

X,1 . 1 8(b)Z, shows

+ 8Z,_ 1 of Example 1 .3.2 with 8 = 0.95 and Z, N(O, 1 ). Figure

the corresponding sample autocorrelation function at lags

EXAMPLE

=

�

0, . . . , 40. Notice the similarity between p( · ) and the function p( · ) computed

as described in Example 1 .3.2 (p(h) = 1 for h = 0, .4993 for h = ± 1 , 0 otherwise).

EXAMPLE 1 .5.3. Figures 1 . 1 9(a) and 1 . 1 9(b) show simulated observations and

=

the corresponding sample autocorrelation function for the process

Z, 8Z, _ 1 , this time with 8 = - 0.95 and Z, � N(O, 1 ). The similarity between

p( · ) and p( · ) is again apparent.

+

X,

Remark 7. Notice that the realization of Example 1 .5.2 is less rapidly fluctuating

than that of Example 1 .5.3. This is to be expected from the two autocorrelation

functions. Positive autocorrelation at lag 1 reflects a tendency for successive

observations to lie on the same side of the mean, while negative autocorrelation

at lag I reflects a tendency for successive observations to lie on opposite sides

of the mean. Other properties of the sample-paths are also reflected in the

autocorrelation (and sample autocorrelation) functions. For example the

sample autocorrelation function of the Wolfer sunspot series (Figure 1 .20)

reflects the roughly periodic behaviour of the data (Figure 1 .5).

Remark 8. The sample autocovariance and autocorrelation functions can be

computed for any data set { x 1 , . . . , xn} and are not restricted to realizations

of a stationary process. For data containing a trend, I P{h) l will exhibit slow

decay as h increases, and for data with a substantial deterministic periodic

component, p(h) will exhibit similar behaviour with the same periodicity. Thus

p( · ) can be useful as an indicator of non-stationarity (see also Section 9. 1).

30

1 . Stationary Time Series

5

4

3

2

I�

IV

0

�

� \A