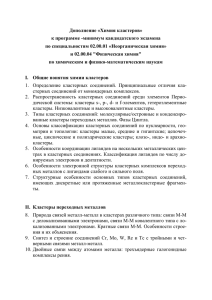

Tin Market Overview

реклама

Tin Market Overview Key Areas of Tin Application World Tin Consumption Structure Glass 2% Other 8% Chemicals 14% Brass & Bronze 6% Tin plating 16% Solder 54% Tin is an indispensable metal for electronic, chemical and food packaging industry Source: ITRI Tin World Consumption Dynamics Average consumption growth, 1970-2014 The tin consumption growth in solders is mainly due to environmental restrictions in lead application in place in EU, USA and other countries; Iron Ore Copper Aluminium Global tin application in key areas, apart from solders generally remains stable since 2004 despite price rises. Nickel Crude Tin 0.00% Since 2000 1.00% 2.00% 3.00% Tin World Consumption Dynamics 400 Stable long-term growth. 350 Solder 300 250 Tin plating 200 Chemicals 150 Brass & Bronze 100 Glass 50 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 Other 2000 0 Source: ITRI Demand for the metal increased in the 2000 due to the transition to lead-free solders applications based on new regulations in China, EU and Japan (IDEALS). IDEALS Program is designed to increase service life of electronics and improve environmental aspect of electronics production while transiting to lead-free soldering. GLOBAL TIN PRODUCTION AND CONSUMPTION GEOGRAPHY World Consumption Structure Other countries; 7% Japan, 8% Tin production, Ktpa USA, 9% Russia China, 41% Australia Malaysia Vietnam Brazil Congo SE Asia, 18% *Syrymbet Production forecast Kazakhstan Bolivia Peru Indonesia EU, 17% China 0 20 40 60 80 100 120 140 Source: ITRI Tin price historical chart 30 000 Tin price, $ 25 000 Current tin price= $20, 500 20 000 15 000 ITC regulations Strategic reserves sales 10 000 Reserves purchase in USA 5 000 Production growth – Malaysia, Thailand 0 Source: ITRI EU, China, Japan Production RoHS growth - directives Indonesia Tin Market Balance and Tin Price Dynamics 2005 Tin production, K t 2006 2007 2008 2009 2010 2011 2012 2013 2014 346,7 357,1 353,8 339,5 335,6 354,6 354,3 334,7 338,4 345,8 7,7 9,3 7,7 3,7 0,0 0,0 0,0 0,0 0,0 0,0 335,5 367,7 372,7 350,7 322,3 362,2 359,4 339,5 348,3 356,6 18,9 -1,3 -11,2 -7,5 13,3 -7,6 -5,1 -4,8 -9,9 -10,8 LME 16,7 13,0 12,2 7,8 26,8 16,4 12,1 12,8 9,7 7,0 Producers 20,9 24,1 25,7 35,4 28,0 20,8 25,0 15,9 14,1 12,0 Buyers 11,4 12,6 13,7 12,5 11,6 11,1 9,6 10,7 11,0 10,0 49 49,7 51,6 55,7 66,4 48,3 46,7 39,4 34,8 29 Government reserves sales, K t Tin consumption, K t Market balance, K t Stock reserve distribution Total Source: World Bureau of Metal Statistics, ITRI, US Bureau of Mines Price scenarios to 2023 US$/tonne 60,000 Central Forecast 50,000 Weak demand scenario 40,000 Forecast range 2019 – 2023: $20,000 - $50,000/t Supply constraint scenario 30,000 20,000 10,000 0 2007 Source: ITRI 2009 2011 2013 2015 2017 2019 2021 2023 ТОР 10 Metal Tin Producers # Company 2013, Kt 1 Yunnan Tin (China) 69,760 2 Malaysia Smelting Corporation 37,792 3 PT Timah (Indonesia) 29,600 4 Minsur (Peru) 25,399 5 Thaisarco (Thailand) 22,847 6 Yunnan Chengfeng (China) 16,600 7 Guangxi China Tin (China) 14,034 Syrymbet (Kazakhstan) 12,000 - 14.000* 8 Metallo Chimique (Belgium) 11,350 9 EM Vinto (Bolivia) 10,800 10 Gejiu Zi-Li (China) 7,000 *Production Forecast Source: ITRI Why today is the best time to invest in tin 1. Global tin shortage – recent years production level is below consumption and the situation deteriorates. 2. Low level of stock inventory – a current global metal tin stock inventory may sustain a 34day consumption as compared to 1960, when the stock inventory would sustain years of global demand 3. The days of easy-to-mine Asian placer tin are now over. For instance, production dropped from 77 Kt to 2 Kt in Malaysia, from 35 to 2 K t in Thailand, from 140 to 80 K t in Indonesia. Tin production cost is up to $25,000 /t. 4. Due to low tin prices in the 1990 and 2000 there haven’t been any new deposits developed; there is no any option as to quickly rump up the production in place of depleted deposits. All major current operations have already seen their production top and are currently in recession. 5. Tin part in cost of ANY final product is below 1% (averaging 0.1-0.2%). Any future tin price rise will not have any impact. Tin is an absolutely green metal, posing no harm to human. 6. Tin price is expected to rise.